Want to Be a Lazy Seeker of Financial Independence? Then Invest in Your 20s.

Earlier this week I visited one of my favorite people ever up in New Hampshire: my friend Purple, who blogs over at A Purple Life. We met up and immediately embarked on a four-mile stroll along the state’s oceanfront, chatting about everything from our travels to tidal waves to the pros of the winter season. Somewhere in there, I told her I was registering for courses on screenwriting and ASL. She had recently completed an immersive (and intense) Spanish course, so we’re both keeping busy learning new subjects.

Now, not too many folks out there will bash walking for multiple miles, or our financial independence focus, as being lazy. The “laziness” label more easily applies to our lounging on overstuffed couches, discussing ideas for a movie night/sleepover while devouring pizza. Which, honestly, was pretty freaking sweet.

If we wanted to embrace that couch potato lifestyle, we totally can with little repercussion.

Y’see, I’m closing in on hitting a net worth of $300,000 (market willing, of course). I can take a hefty pay cut tomorrow and still end up financially independent in my 30s. And Purple? She’s been financially independent now for about two years, spending her days traveling far and wide as a happy retiree at 33.

We both see laziness as a marker of a quality life. As a result, we both began the financial independence path in our 20s to ensure as many years of being lazy as possible. Neither of us began with high salaries or with hotly-demanded skills, either – we simply learned about the advantages our 20s would grant us and are now seeing those results.

The 20-Something Investor is the Most Powerful

Almost all of today’s most famous investors are wrinkly old fartbags. This tends to give the impression that

- It’ll take you multiple decades and unfathomable luck ‘til you can enjoy wealth,

- All the good investing opportunities dried up decades ago, or

- Young people just shouldn’t try to get ahead until they’re older and wiser

Not so! On all counts! As it turns out, it’s actually the youngest investor in the room that’s the most powerful. If you’re currently in your 20s, you will come out way ahead of folks 10-40 years older than you who are putting in double the effort. This is because you have a much more valuable asset than excess cash capital: time.

The earlier you start investing, the less money you’ll need to put in upfront to get huge gains later on. Thanks to the magic of compound interest, you’ll only need to put in half (or less!) what others in their 30s or 40s will have to put in. As Business Insider explains:

Two people save $100 a month for retirement, each has a 5% annual compound rate of return, but one starts at 25 and the other starts at 35. The one who started at 25 will have saved nearly twice as much by age 65.

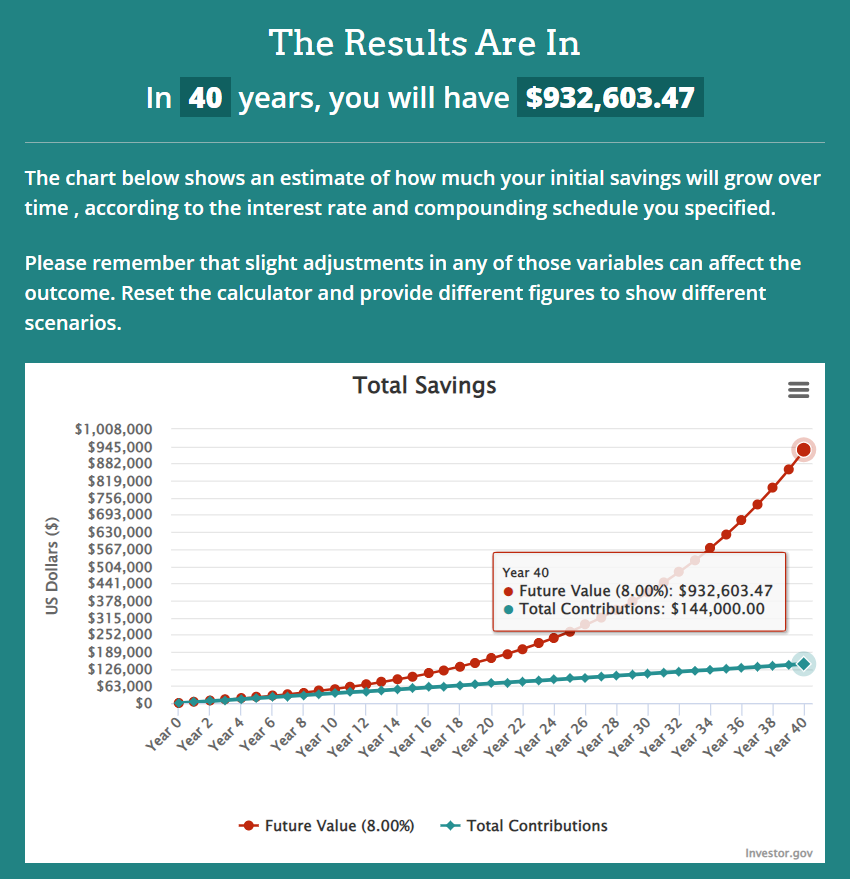

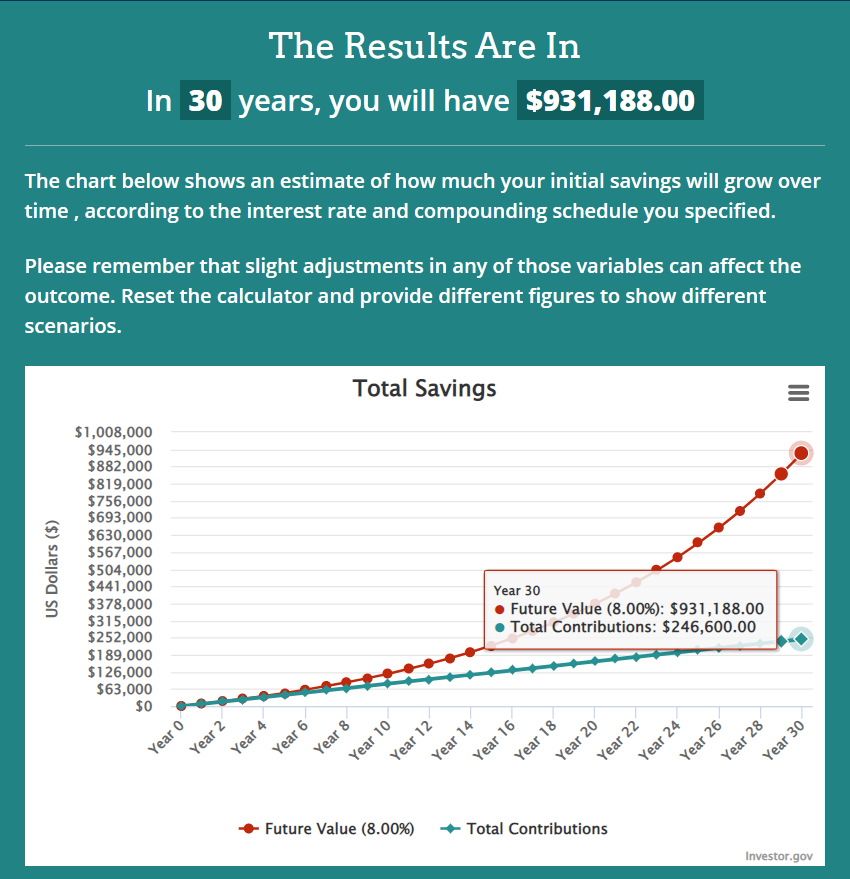

Any compound interest calculator will spell this out neatly. If a 25-year-old starts contributing $300 a month into investments, that translates to $3,600 a year. Assuming an 8% annual return on this investment (which is less than the historical average for index funds, by the by) they will end up with a cool $932k for retirement. A 35-year-old would have to put in $685 a month to get roughly the same amount… and contribute almost double the amount of money.

When You Invest Even More

It’s really nice to think it costs so little for riches as long as you’re young. It makes the case easy to show how a little investing now goes a long way later, literally. It’s the epitome of laziness. Contribute less than half of an IRA’s limits and you’re set.

Which then begs the question: what happens if you choose to invest more than this minimum?

I can answer that question from personal experience, having ran the numbers and evaluated what investing early has offered me. Short answer is, it lets you be ultra-lazy, yet with a future with financial independence.

The long answer means I get to weigh a lot more alternative paths if I so choose.

Should something terrible happen that causes me to lose my job/be forced to take a 50% pay cut, I’m still set. As long as I don’t touch my current index fund investments, compound interest will make me a millionaire in my early 40s.

Things are, understandably, better if I keep my same salary at ~$105k. At this point in time, I don’t need to save up as much as I do at all. Say I choose to cut my savings rate down to 20%-25% of my post-tax income per year, which is roughly $20,000. (For comparison, I saved 45% in 2021.) Because I started saving early, I can relax after just five years and halve the amount I save to reach:

… half a million dollars in the next five years,

… $1.3 million when I hit my 40th birthday, and

… celebrate my 50th birthday (23 years from now) with $3.7 million.

Who wouldn’t want this kind of assurance? It’s a good time to be lazy when financial independence means there’s nothing to worry about.

Aspiring to Laziness

$20,000 is less than half of what I currently save on my income. I could save more if I sold my car and got a roommate, but that’s not necessary to reach my financial goals. This is what chasing after a high income + good money management will get you. I no longer need to do the chasing if I don’t want to.

Similarly, I no longer need to actively handle my finances like I once did. All I have to do is stick to my budget and follow my dead-simple investment strategy. No more hawkishly checking my balances and distributions over here, no ma’am. In all states except physical, I am sipping a Mai Tai on a beach, absolutely unbothered as I soak up the sun.

We are all busy people. Not everyone has significant amounts of time and energy to reach the ultimate assurance in financial independence. If just the thought of chasing financial independence seems more like a death march than anything else, that makes you one of the normal ones. All it means is, you should see where the balance is between the finish line to your financial goals and the amount of energy you’re willing to spend.

Purple has quite a few great articles on laziness to help you refine your path.

Our laziness, when done right, makes a positive difference:

- How Being Lazy Helped Me Retire At 30

- How Laziness Saved Me From Bad Financial Decisions

- Why Rest Is The Key To Creativity

- Why I’m An Unproductivity Advocate

Laziness gets a bad rap. Its definition isn’t narrow enough to apply solely to “those who leech off of others and contribute nothing to their life or world”. There’s more to the word than that, much more than decades of full-time work can permit you to see.

Cover image credit: Steph Q. via Unsplash

Well said Darcy, it’s like the saying : “time in the market is more important than timing the market “

Great article, Darcy. Most young people don’t know enough that “compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” as Einstein once said. The earlier you start to invest the better it will be IF YOU remain invested (easier said that done). I try to do this via my All-Weather Portfolio (currently consisting of 40 buy-and-hold-forever stocks, portfolio value approx. $600,000). Keep up the good work and help educate the next-gen of investors! Cheers from Singapore, Noah

Pingback:Beat 80% of Investment Managers With this One Weird Trick - We Want Guac

Pingback:T.G.I.F. Friday: Volume 80 - Accidental Fire