My Money in 2021: The Biggest Everything Ever

Oh, 2021. You somehow managed to continue the shit parade 2020 started. Beginning, as you did, with the very first week! Forget about my 2021 spending for a sec – what was all of that attempted-coup, burning-down-the-very-institution-of-democracy farce you gave us front row seats to?? And the news just kept giving nothing hopeful from there.

Now, admittedly, my cushy job and financials cushioned me from a lot of stress and worry. If I was a sociopath who didn’t get stressed over the well-being of others, this last year would’ve been awesome. Why? Because I had a lot of personal finance wins, especially when it came to how much the stock market went up in that period. If you were part of the few who could work from home, and had a good chunk of money invested, AND didn’t have pesky distractions like family obligations or medical issues? Well, then you ended up rolling in it.

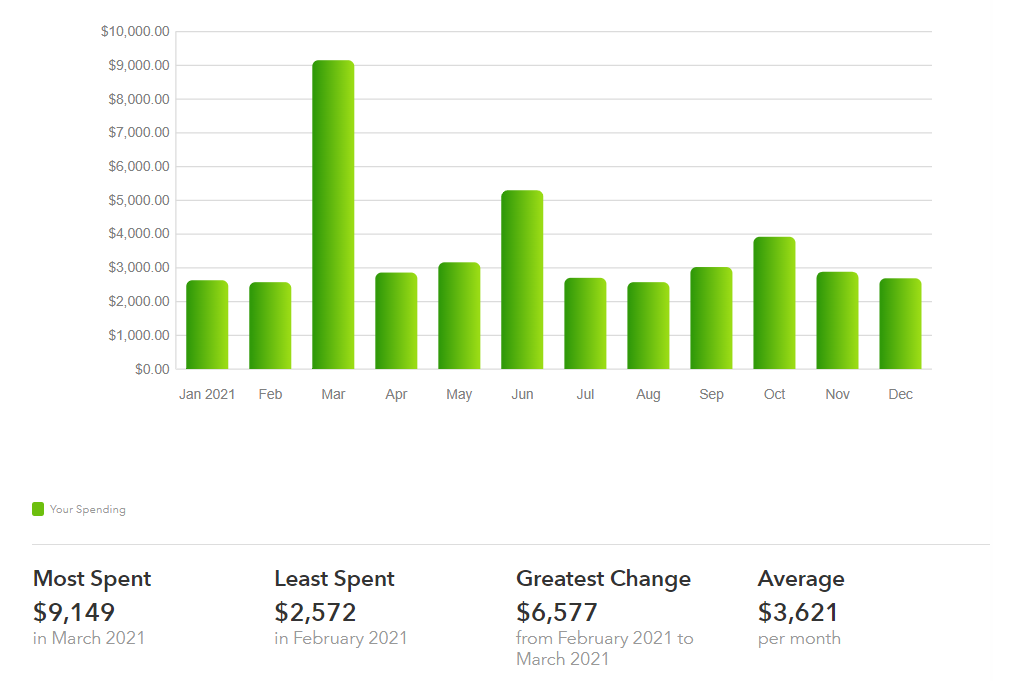

Which turned out to work out well in my case, since my 2021 spending absolutely skyrocketed when compared to the previous years, or even 2020. For perspective, my spending each year shook out to the following:

| Year | Spend |

| 2017 | $13,280 |

| 2018 | $24,985 |

| 2019 | $29,999 |

| 2020 | $30,722 |

As for 2021? Well…

My 2021 Spending

… I dropped a hellton more than I ever have before.

It wasn’t that I started ballooning all of my budget categories. While pandemic stress made me a little more lax with budgeting, it was really two big expensive events:

- Paying for a vacation for two to Los Angeles (another $2k all in, both a graduation gift for Gio and a consolation prize of “sorry your last year of high school got FUBAR’d by COVID”), and

- Buying a car (a little over $10k for the initial purchase, and that was right before car prices went bonkers)

I think this year will stand out as an outlier in the years to come with how much I spent. At least, that’s the hope. I don’t want to be buying a new-to-me car every year moving forward, and I definitely did not fall in love with LA in the way Gio did. Without the two above purchases that I do NOT plan to repeat, it comes out to the $31k range. Which, considering the bonkers inflation we’ve seen this year, is cool with me.

The specific amount I spent, in total, came out to:

$43,441.91

Again, this number is so huge because of two once-in-half-a-decade,-minimum purchases. If I wanted to adjust my $30k spending goal for inflation, it’d be around $31k or $32k for the year. Surprisingly to me, I was right on the money for that. Woo!

According to Mint, I spent the least amount of money in August at $2,572. Which makes sense; that month I was pursuing more rest, which is a nice way of saying “I faceplanted on the shag carpet and refused to move”. You can guess what the big spikes in March and June were, given the context clues. The only other relative outlier, October, was thanks to buying 2 plane tickets and a new laptop. Which has Windows 11 installed and which makes me uncomfortable with the amount of ads. Am I getting old?

The rest of the numbers were relatively tame. $20,400 once again went towards my rent – shoutout to my landlord for keeping it the same rate! $1,818 went to groceries, which shakes out to a little over $150 a month. Since my grocery budget is now at $200 a month with the higher prices, that’ll be a thing of the past 😔

What I also hope’ll be a thing of the past is spending as little as I did on charitable contributions. I went all out in 2020 but didn’t keep that energy in 2021. Despite that, it was good to see I still squeaked into giving $1,854 away in total. Even at a $43k spend that’s still more than the 2.5% I’ve pinpointed before.

My 2021 Income

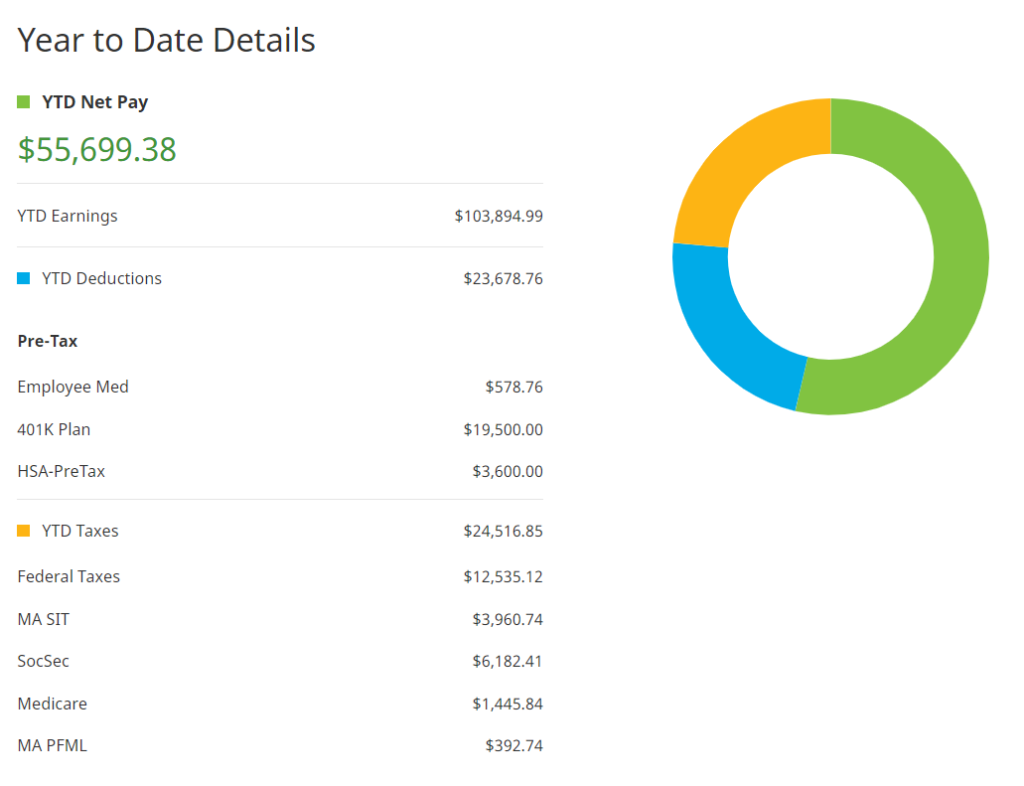

For some reason, Mint isn’t showing all of my pay; I’m pretty sure it’s because I was getting paid across accounts while bank churning and some of them no longer show up. Instead of Mint information you get my pay portal instead!

My net pay for the year (after taxes) was a little over $55,000. Combined with my maxed-out 401(k) and HSA, I ended the year reaching $78k. That’s as much as my net worth grew in 2020! What!

What really toots my horn is seeing that SIX FIGURE NUMBER. 2021 marks the first year ever where I’ve earned over $100,000. This is completely thanks to a five-figure bonus I got for the projects I’ve been managing. Hard work only translated to that compensation because I have bosses that notice and reward my efforts; it’s hard to find jobs like this these days, even with the “labor” shortage taking place.

Beyond my full-time job, I’ve also gotten a boost from several side gigs throughout the months. Doing that was part of my $10k New Years Resolution, which I’ll write about in a follow-up post. Suffice to say, that was the icing on the cake for a one-woman show.

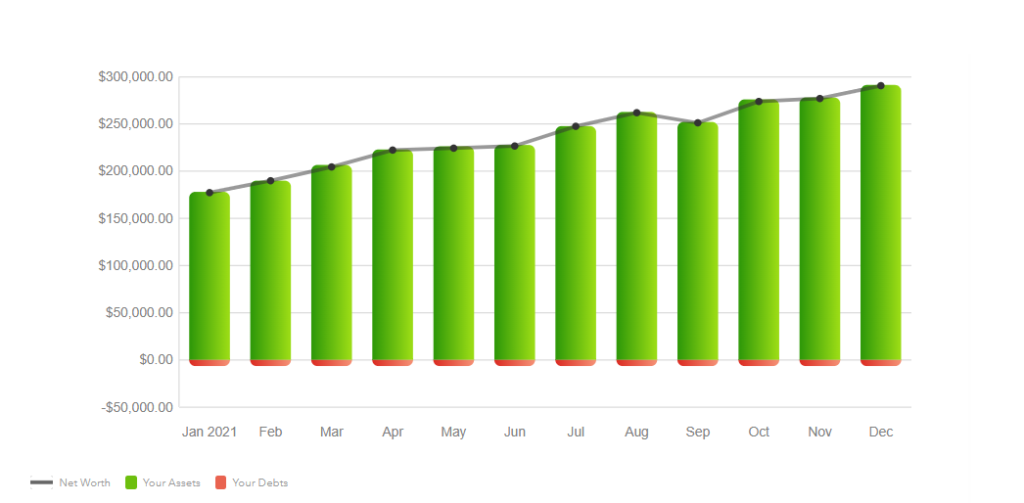

My 2021 Investments

Speaking of six figures, that’s how much my net worth happened to grow by in 2021. Again, for the first time ever. On January 1, 2021, my net worth was sitting pretty at $186k. On New Years Day 2022, it was at $291k. I wrote all about it in my last article, but it was absolutely stunning to see the power of a high income and a huge investment return. Index funds F T W.

In other words, it’s kind of like I saved 100% of my salary to feed into my net worth. Despite spending over 1.4 times the amount I was “used to”. Tell me again, who said this was the boring middle?!

With this one-two combo of earning six figure and increasing my net worth by six figures, that bloated $43k spend is okay with me. But, again, this was only possible because the stock market has been forcefully separated from reality. Profits were so high because of the literal blood sacrifices done in prioritizing economic health over public health. More people died of COVID in 2021 than they did in 2020. This shouldn’t have happened with the vaccines finally arriving in the first half of the year.

Does living a pandemic suck ass? Absolutely. Are the preventative measures, like mask-wearing, uncomfortable and weird? Hell yes. Does the discomfort mean it’s totally justifiable to disregard them completely? Absolutely not. “Rugged individualism” only works in narrow circumstances, specifically if you cannot actually find a community to be a part of. Communities are exactly what humans are designed to keep for survival. If you’re not taking care of your community in the name of freedom, you have a deeply-entrenched ignorance as to what both concepts are.

Looking Ahead for 2022

I’ve gotten more pessimistic about humanity in the last year, that’s for sure. I’m hoping this New Year will help me restore some of the optimism I’ve lost. Until then, I’ll keep control over what I can and, in this case, that’s my finances. 🙂

Since I do not plan on buying another car or West Coast vacation in 2022, I fully expect to see my spending this year to be back in the “normal” range of low 30s.

I say “low 30s” instead of a straight $30k because of a few different variables. One is going to be a spring trip to Atlanta happening mid-March. I’m going with Gio, who’s paying for his own flight this time around. It definitely won’t be as expensive as LA, but I’m still expecting it to break $1k.

But the big buster spending event I’m anticipating is one I’ve wanted to go on for years. Sometime before the fall, I’m also planning to go on an international trip to northern Europe!! This is still very much in the planning stages so I don’t have specific dates, but I’m putting this down here in writing to commit to it. Originally I wanted to do this trip to celebrate hitting a $200k net worth, but, well, corona said no! So once I pick up my booster and a new passport I’ll be heading to the EU for the first time since studying abroad!

Ooh la la!

A huge “maybe” expense may be a move to a whole new state, but it won’t really be an expense. I’ve been wanting to move to New Hampshire for a couple years now to fulfill my dream of living in a mountain forest. However, I’m also now potentially very interested in moving to Vermont. Not only is housing less expensive than its neighbor’s, but it’s also got a really slick program to entice more folks to live there. The state of Vermont is offering relocation incentives if you move there after February.

Turns out, I would qualify for the New Remote Worker Grant. From what I’m reading I’m pretty sure the grant is meant specifically to pay for any and all moving expenses. Which would mean I could move to somewhere less expensive, and more in line with where I actually want to live, for free. If I do that, my 2022 spending will plummet to delightful depths. My current rent expenses are over $20,000 a year, so cutting that via geographic arbitrage would mean a very roomy budget.

Hence the “maybe, but not really”.

Other new-and-expected expenses may include sending Gio $100 each month to help while he’s in school (and help focus on schoolwork more than retail). If inflation keeps up I’ll also be upping my grocery budget; I did this already in 2021, bumping it from $125 a month to $200. Will I also do it for my other budget categories? I’ll leave that open for Future Darcy to decide!

I’ll sign off with the same adage I had in my 2020 roundup: here’s to a better year. While I’d be deeply grateful if that translated to another blockbuster money year, “better” would more greatly serve easing the effects of the pandemic. That would be nice to see. Please. Otherwise, here’s to hoping all of you lovely people find further stability and peace in the coming year ahead. We’re gonna need it.

Cover image credit: Hulki Okan Tabak via Unsplash

Ironically current covid infections are at a record high and deaths, which should be low for omicron, are still quite high. It was quite a year, completely normal for retired people like me and my wife whose hobbies are naturally socially distanced and do not require masking. Hiking, running, tennis, fishing and off roading are pretty much as safe as sitting at home in Arkansas. The stock market made us $275K wealthier in 2021 even though I barely earned any money and we spent quite a bit. Nobody in our extended families got covid. I lived through major surgery and came out stronger and faster than I went in. So all in all one of my best years ever. Which is strange when many people suffered and lost incomes and so many kids have had their social development derailed. Here’s to a better year, Darcy!