A $250000 Net Worth Update!

After hitting $200,000 in February I asked “How long do you think it’ll be until I hit the next milestone?” and left it at that. Turns out the answer was “THIS YEAR, MONTHS BEFORE YOU EXPECTED TO HIT IT”. Yep: when you have that much money invested already – AND the stock market defies all odds and keeps going up – reaching a $250000 net worth isn’t that far out of reach.

I first saw the 2-5-0 in late July (which was a stellar birthday present!) but wanted to wait until my last paycheck hit so it’d stay that way. And so far so good with that staying power; thanks to that I’ve graduated from DemonFI and am now at QuarterFI. That comes with a shiny new badge in the sidebar to boot!

I’m not alone in reaching this milestone, either. DQYDJ places those with a $250000 net worth in the 65th percentile of all Americans*. That means 35% of my fellow citizens have at least that much or more. If you’re one of the 35% or aspiring to it, this article is for you.

$250000 Net Worth in Perspective

Two thousand dollars is less than 1% of my net worth. And $100,000 is LESS THAN HALF. What!

I had wondered if my buying a car and dumping stacks on a vacation would have a big impact. Looking at it now shows it barely slowed down my net worth growth. A $250000 net worth is the point where spending ten grand won’t make-or-break your growth. As wild as it is, $10,000 only makes up four percent of that net worth.

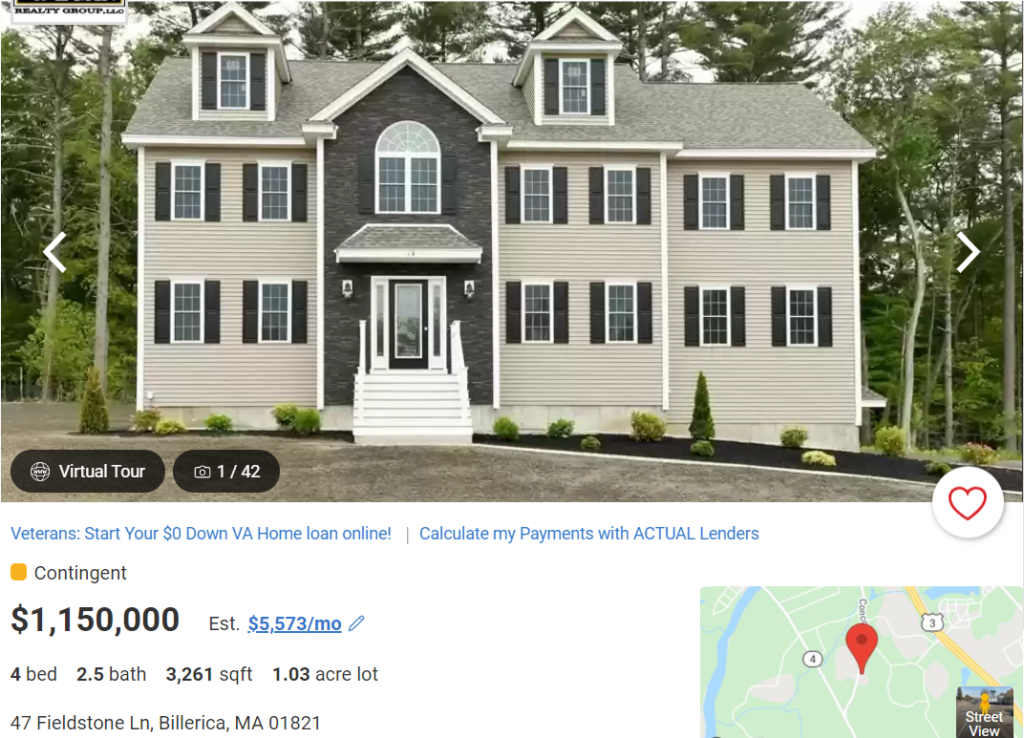

The numbers are one thing here. Being able to visualize what that could buy is another. Here’s some of what you’d be able to gain with a $250000 net worth:

- The ability to say “I’m worth a QUARTER MIL”. It just rolls off the tongue.

- $25,000 average growth per year when invested in index funds

- Becoming a millionaire in 15 years (at 42) without contributing another penny

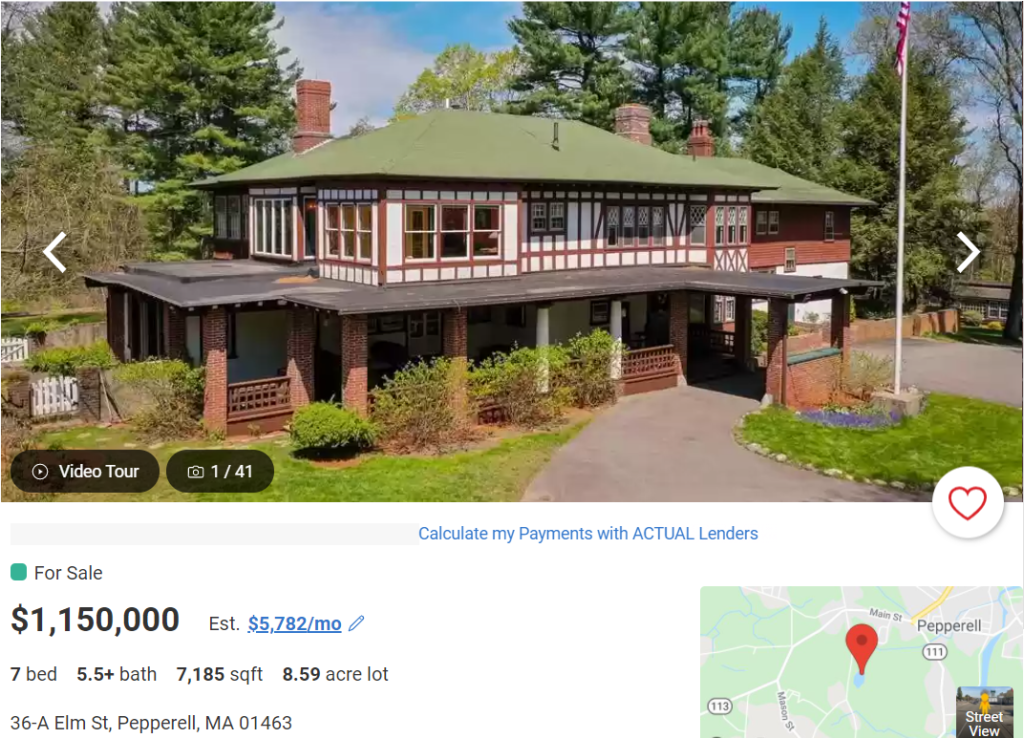

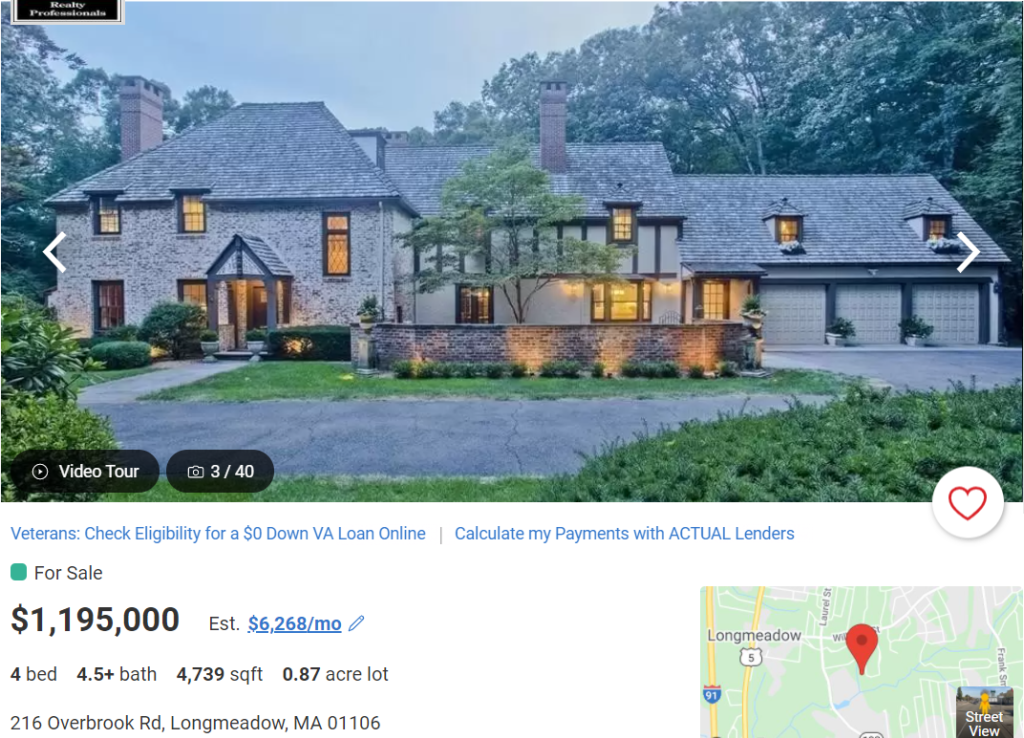

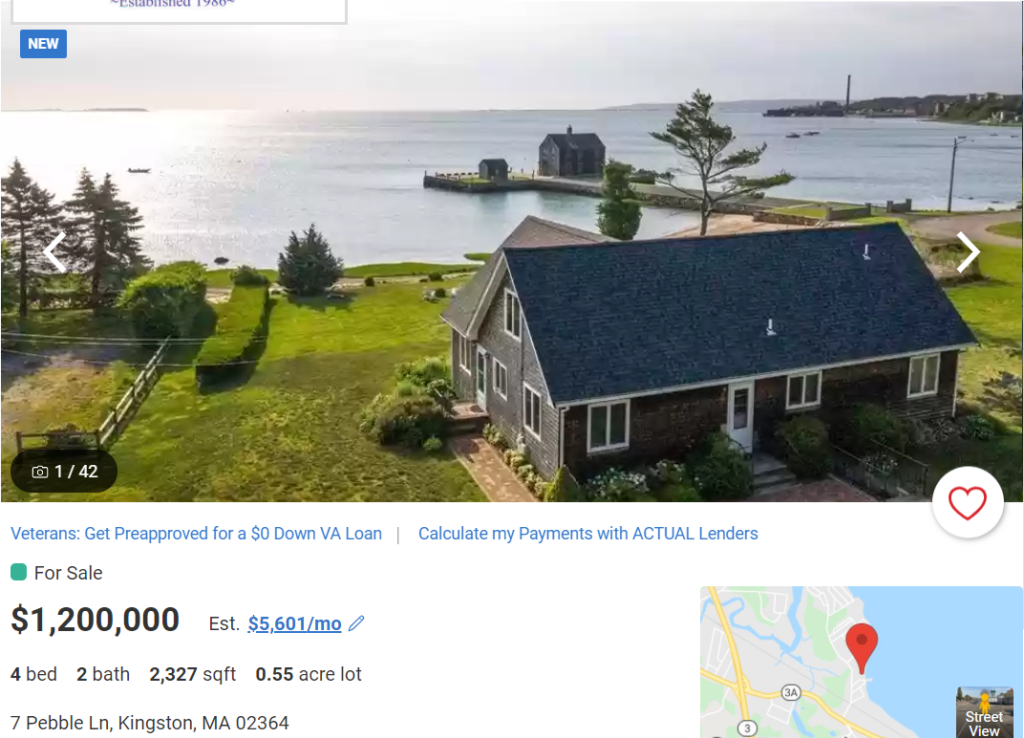

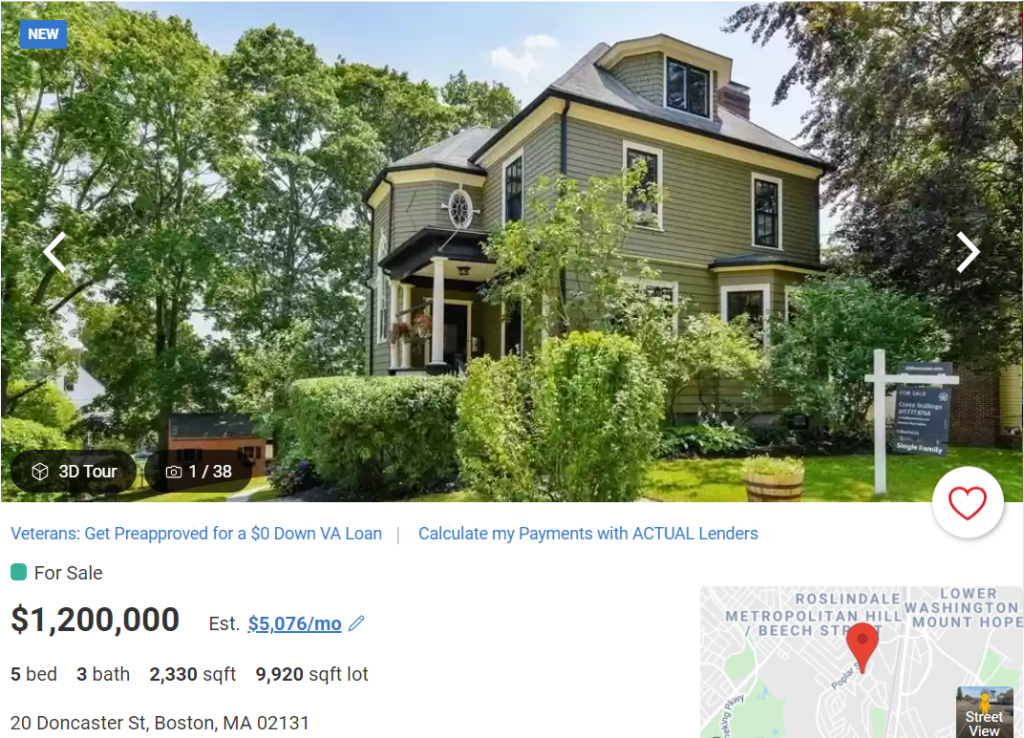

- More than cover a down payment on a $1.2 million house (see slideshow above!)

- 125 vacations totaling $2k each

- 3 Tesla Model X cars, with cash left over. Since the Model X is the most pricey of the versions Tesla has, you could also straight up buy one of each model and have $60,000 left over. Imagine strolling into your nearest Tesla dealership, gesturing vaguely at the showroom models, and telling the salesperson you’ll take all three. The flex. The power. They’ll gag.

- Over 76,000 orders of Chipotle chips and guac. Because this site name would go to waste without it.

Where My Money Actually Is

Of course, this goes with the assumption you could access your funds immediately. If you’re like me, this is easier said than done. Let’s suppose I actually wanted to buy the house or the Teslas or the Chipotle as soon as humanly possible. To do that, I’d need several weeks to sell off my investments and magically not pay any penalties/fees. This is, specifically, because my money is currently invested or invested in tax-advantaged accounts.

The breakdown:

- 40% – taxable

- 4% – crypto

- 5% – cash

- 51% – tax advantaged accounts

I have so much in tax-advantaged accounts because, well, it’s worth it to do so. If you’re earning an average $50,000 salary and put $12,500 into a 401(k) – which should be doable for the average young person – you’ll end up with four figures more invested than you would have otherwise. The bigger your salary, the more money you’re keeping; this compounds even more if your company offers a 401(k) match to boot.

The taxable account takes the second-largest slice of the pie because that’s the account I first started investing in. My first two full-time jobs out of college didn’t offer 401(k)s so I turned to Vanguard for my investments instead.

Mint says I’m currently $1,554 in debt. That is because Mint counts your credit card balance as “debt,” which is technically is. I pay it off in full every month so my effective debt rate fluctuates between 0% and 0.1% of my net worth.

Okay, so… why crypto?

The last time I bought into crypto was back in 2017. I don’t plan to buy any more and need to get around to selling it off; I’d rather not support an asset that directly destroys the environment, no matter how much money it might make me.

Does This Affect Your Spending Habits?

If you’re like me, it took (or will take) strict sacrifice to reach a $250000 net worth. Money doesn’t grow on trees; if it did we’d be grabbing those dollars right along with the good stuff. However you reached this milestone, the most important thing is making sure you don’t go bananas and spend it all. You want to make sure it continues to grow your wealth, preferably with double digit returns. Once that’s taken care of, I highly recommend you take a look at your spending history and think about whether that should change moving forward.

This was really helpful for me when I felt like I’ve been spending a ton this year. Turns out, my spending since May 2018 has been surprisingly consistent. Out of the last 40 or so months there have only been 5 of those where I spent more than $3,000. The three of those in 2021 were from the aforementioned big purchases of car plus vacay.

It also made me feel comfortable enough to expand my budget in a controlled way; I’m trying to make sure I do this sustainably instead of giving in to lifestyle creep. My grocery budget is going up to $160 per month, which means I’ll now spend about $40 a week on foodstuffs. With food prices surging I would have had to up it anyway, but by reaching a $250000 net worth first I feel zero anxiety over the decision.

You should also consider this. As long as you maintain control over what you’re spending and ensure it aligns with your goals and dreams, you’re solid. Go spend that money on a nice dinner or toy to celebrate. Go apeshit. You’ve earned it!

The Next Milestone

Now that I’m at a Q U A R T E R M I L, how long will it take to reach the next milestone ($300k)? Right now I’m still basking in the joy from reaching this point, so who knows!

Since >90% of my wealth is invested anyway, there’s no easy way to tell. Mr. Market will gyrate any way he pleases in the coming months, just as he has for several decades. Will it be mere months like the last two milestones? Shorter? Longer? Guess we’ll find out! There’s way too many variables that go into stock market pricing for me to keep track of; this isn’t an easy thing to predict like other things might be.

*If you choose to ignore home equity, that number jumps to the 75th percentile. Which is MORE mind-blowing.

Cover image credit: Casey Murphy via Unsplash

Wohoo! Congratulations on hitting the quarter mil mark! You continue to be such an inspiration for your generation.

The larger your investment portfolio is, the faster it grows. So enjoy that beautiful acceleration courtesy of compound interest! And you def earned yourself a little extra spending money on groceries (or guac). Once you start to hit the larger milestones, loosening the purse strings a little bit (not crazy, but going from strict saving to a indulging a little bit more) will help sustain you on the long journey to Financial Independence. 🙂

Right on the money!! Some finance stories of saving a ton of money just aren’t sustainable in the long run; might need to do some more evaluating and rebalancing if that’s what’s needed.

Congrats Darcy! I know, I shouldn’t try to time the market, but I’m going to place my bet here and now. I think you’ll hit $300k by the end of this year!

That would be freaking awesome 🤩 And also a $100k+ gain in one calendar year… eep

Congratulations Darcy!!! You’re killing it!!! You’ll make 300K by January for sure.

Thanks friend!!! I’m hoping I’m showing folks it can truly be done when you don’t have those family connections/mentors/college alumni networks to work with. Onto the next one!!

Excellent work here and nice distribution on tax-advantaged accounts. I sometimes think I overutilized tax-advantaged accounts (I am up towards 70% including my HSA.

Take care, Max.

So your invested in stocks and Crypto only ? No real estate? Also are you just in index funds or a mix of individual funds as well? Sorry for all the questions lol

Ask away! My money in crypto is more akin to “gambling” instead of “investing” at the end of the day. I live in Boston so no real estate at these prices; as for index funds I like sticking with total market or S&P 500 funds overall! There might be some bond funds in my Roth IRA from 2017 but beyond that there isn’t much need for variation.

Congrats! It is crazy to reach the point where the market dictates your net worth more than your next paycheck/monthly income. It’s out of my hands, but still feels good to reach milestones like this! I’m also in a high cost of living area (SF Bay Area) so no real estate for me either, just chucking money at the taxable account once Roth/401k are maxed. Keep it up!

Pingback:Okay, But Are You Resting? - We Want Guac

Darcy–I love your posts. You should be the first person anybody sees teaching these principles in every school starting from grade 1 to PHD. Most Americans will sadly be eating their pets or same food as their pets because they are nowhere close to your financial acumen. I have a question though: in your $100,000 post you said that put you in 64th percentile. So it seems the 65th percentile is a little low for $250,000?

Your comment made my week Mike!! (The part about being the first person, not about the pet food.) That’s a great eye too about the percentiles and the difference comes from what’s being measured. In this post I chose to include home equity in the percentile calculations; if I ignored it (as I did in the $100k post) the percentile becomes 75%. I’m adding a quick edit now to better reflect the difference, thanks for bringing it up!

Pingback:Want to Be Lazy? Then Invest in Your 20s. - We Want Guac