The Magic of Compound Interest, Revealed!

With so much doom and gloom, it’s time to remind you that magic is real. I’m not the one to tell you about goblins and ghouls and the faeries of olde, but I’m delighted to tell you about a more modern form of magic. “Compound interest” sounds cold and industrial at the outset when that dreary name masks the glittery core of magic within. It’s simple! Easier to learn than any sleight of hand! Even federally recognized AS MAGIC!

Not even joking with that last point; it ain’t April. Compound interest magic is a real part of our world today that YOU can take full advantage of. To understand it, look at regular ol’ interest. If you’re getting 5% interest on $100 you lend a friend, that means you’ll get your $100 back plus an additional five percent ($105). Which is pretty cool. Compound interest means you get back that $100, plus that $5, PLUS the interest that $5 has also earned you. Interest earns interest earns interest, which can easily be replaced with “money” or “more gravy” or, I dunno, “f r e s h g u a c”. That interest keeps multiplying, or compounding, and you’re left with more and more money as long as you keep it all invested.

And that’s it.

Well… that, and the one other caveat of investing it in the right thing.

Enter: Index Funds, Stage Right

No matter what hotshot stock or company you invest in, it’s very hard to predict how well your shares in the enterprise will actually perform. Because of this volatility I like to bank on something more general and assured, like the innate drive of human innovation. That’s not me getting all grand and mighty with you; it’s me deciding to go with index funds as my preferred investment choice.

Index funds are for the beginner investors and lazy future millionaires. They’re a baseline for evaluating the returns of any particular investment, being the true “set it and forget it” type of asset. If your entrepreneurial venture or other moneymaking deal can’t beat its return, why bother putting in extra? At this stage in the game, I wouldn’t put my compound interest returns at risk like that.

I’ve even got the cold hard facts to prove me right.

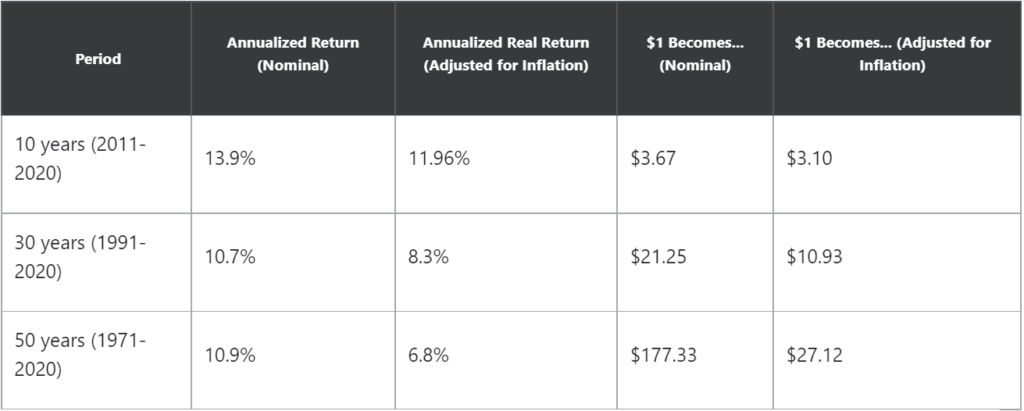

Since its inception in 1926, the S&P 500 – most used to represent the entire stock market – has been 10-11%. If you look at all of its returns since 1970, the average is 10.9%. Since 1990? 10.7%.

Now I don’t know about you, but those are encouraging investment numbers. Why should I have to go through the drudgery of picking individual stocks that might do well? I mean, with an index fund I’ve got as close to a guarantee of double-digit returns as you’re gonna get in business.

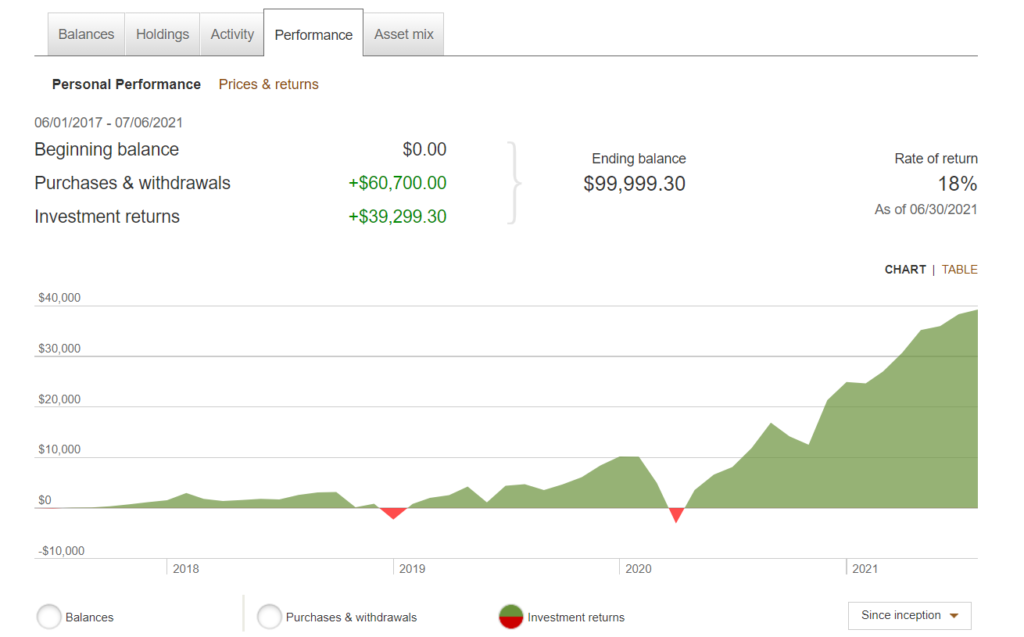

My Vanguard account is the perfect example. In it I hold only their VTSAX index fund (along with exactly 8 shares of GameStop for the lulz). Since 2017 I have invested roughly $60,000 in that index fund. Thanks to VTSAX, I have “earned” almost $40,000 in returns on that.

That forty grand was not a typo.

That’s an amount from investing for only FOUR YEARS, people!

This is during a big bull market when it clearly didn’t take much stock-picking to make some moolah. But also during a bear market in March 2020. At that time I saw my net worth fall by roughly a third; for every three dollars I had in February, I had two in March. In response to this sudden and dramatic change, I set into motion a particular plan. A plan I’ve honed for almost half a decade at that point. A plan that would see me through to the other side of this crisis with almost double the original amount.

I can now sum up this stroke of brilliance and ingenuity into three simple, bounteous words to reveal how I came out totally unscathed:

I did nothing.

Yep, didn’t change the way I did things whatsoever. It took until June to reach my former high. Then it skyrocketed to the $245,000 I have today (so close to QuarterFI!) Compound interest, that lovely federally-designated magic it is, is how I’m now closing in on a quarter million dollars. And you, too, should get in on this abracadabra party! Promise, it doesn’t take much to get admitted!

How You Can Enjoy the Compound Interest Magic

Let’s say you have a thousand dollars. Getting that to grow by ten percent in one year means you now have eleven hundred dollars. Now, that hundo is making it grow even more. Another year and you’ve now got $1,210. At the end of Year 5 you’ll have $1,610. At the end of Year 10 that’s almost $2,600. That’s all WITHOUT you adding more money to the amount – just leave it in that index fund and let it ride, baby.

| Year | Amount |

| 0 | $1,000 |

| 1 | $1,100 |

| 2 | $1,210 |

| 3 | $1,331 |

| 4 | $1,464 |

| 5 | $1,611 |

| 6 | $1,772 |

| 7 | $1,949 |

| 8 | $2,144 |

| 9 | $2,358 |

| 10 | $2,594 |

I deliberately used a “small” number here to best illustrate how much more you can get. The bigger the numbers get, the better.

Have ten thousand dollars invested? Watch that grow to over $26,000.

| Year | Amount |

| 0 | $10,000 |

| 1 | $11,250 |

| 2 | $12,375 |

| 3 | $13,613 |

| 4 | $14,974 |

| 5 | $16,471 |

| 6 | $18,118 |

| 7 | $19,930 |

| 8 | $21,923 |

| 9 | $24,115 |

| 10 | $26,527 |

Fifty thousand? You’re looking at a solid $129,650.

| Year | Amount |

| 0 | $50,000 |

| 1 | $55,000 |

| 2 | $60,500 |

| 3 | $66,550 |

| 4 | $73,205 |

| 5 | $80,526 |

| 6 | $88,578 |

| 7 | $97,436 |

| 8 | $107,179 |

| 9 | $117,897 |

| 10 | $129,687 |

Have a hundred thousand dollars invested? Way to go, that’ll be $259,300.

| Year | Amount |

| 0 | $100,000 |

| 1 | $110,000 |

| 2 | $121,000 |

| 3 | $133,100 |

| 4 | $146,410 |

| 5 | $161,051 |

| 6 | $177,156 |

| 7 | $194,872 |

| 8 | $214,359 |

| 9 | $235,795 |

| 10 | $259,374 |

It’s especially awesome to use this 100k example because that’s right about the time you’ll see crazy gains. Why? Because 1% is one thousand dollars. Because getting an average (10%) return is watching your investments go up by five digits without adding another penny in.

And so on, and so forth.

This is hard to do if you have a below-average salary. But remember, you’re still young and you’re going up against the cogs of capitalism. As long as you can reach an average salary of $50,000 – while managing your spending – you can put five figures towards your investments each year. Even more if you have access to tax-advantaged accounts like a 401(k), because then you don’t have that tax taken out.

Compound Interest Pays The Most RIGHT NOW

Thanks to the magic of compound interest, I could stop saving completely and STILL become a millionaire. The only reason I can do this so quickly is because I got started investing while I was still super young. Time is the most important asset to have to earn the most compound interest; as a youngin, that’s what you have in spades, no-guarantees and YOLO aside.

You’ve practically got me on my knees if you haven’t yet hit your 30th birthday. PLEASE, y’all, PLEEEEEEEEEEASE start investing RIGHT NOW! It’s not going to affect me at all, this begging is solely to give your future self a much more phenomenal life. Please please pleaseeeeee start investing today! This week! As soon as humanly possible!

Think of the corporations!!

Besides tax dodging and underpaying their employees, this is one of the core ways the rich continue to get richer. And they teach their kids to get this done as early as possible, too, so they can similarly get in on the action and perpetuate generational wealth. You don’t earn as much if you want until you’re 30 to get this sorted.

Since you’re young, it’s YOUR money that’s going to have the most time to compound that interest and work that sexy magic. The mega rich want to squeeze as much money out of their companies as they can and YOU can benefit!! Not only that, they’re more jealous of you than you can possibly imagine. Why wait for the revolution to go eat the rich? Do so metaphorically and get in on the action ASAP!!!

In all seriousness, this investing stuff is best used at the earliest possible time. Today’s dollars are the most valuable in terms of growth in the long run. In my case I only had to save for five years to have a smooth ride to retirement. Imagine not needing to worry about saving a penny towards your future because you’ve got a nest egg already generating what you’ll need. I don’t know anybody who wouldn’t pass up the chance to use those savings for other endeavors. The goals and dreams you could pursue with that extra cash are utterly extraordinary.

Getting Started

You don’t need that much at all to get started. Gio, my 18-year-old hotshot brother, got his set up with roughly a thousand dollars. He’s been adding different amounts since then and is now sitting pretty at $3,000. Most of that is from his contributions, but that three grand includes hundreds of dollars in gains. Those gains will now similarly earn more money thanks to magic compound interest. All you need to do is open an account, invest in an index fund, and bippity boppity boop bitch you’re done.

If you’re deciding on where to open an account, I’d recommend a large brokerage like Vanguard or Fidelity for their low-cost index fund options. Follow the prompts to set up an account, transfer your money in, and buy the index funds you want. And keep going from there. That is how you can make an income stream for yourself that requires next to zero work. It’s how you get in on that magic compound interest. Most importantly, it’s how you set up the most awesome array of options for yourself further down the line. This can mean financial independence a la FIRE. Or, really, anything you damn well please. It’s your life, after all. Set yourself up for a nice one with doing exactly this.

I’m not here as your fairy godmother or Hogwarts professor so I can’t offer you garbled words to transform your life. What I can do instead is offer you some assistance to transform your life instead. No wands needed.

Cover image credit: Sherry Wright via Unsplash

bippity boppity boop bitch! lol….

There was really no better way to write that. Shakespeare wishes he could.

Seriously the best public service announcement there could be!

Abracadabra, please and thank you. Invest your money and you’ll be thankful.

Pingback:The Sunday Best (7/11/2021) - Physician on FIRE

Darcy,

That’s a great reminder of how compound interest works its magic! I’ve quoted that ~10% figure before and had readers doubting me, but it really is accurate when looking over the long-term and including dividend reinvestment. The stock market creates crazy appreciation with enough time given to grow.

And while it’s a topic as old as time, I liked your spin on this magic by alluding to how it can work “in the background” if you save for retirement early so folks might not need to live a particularly intense frugal lifestyle for long periods—just a handful of years to have a nest egg left untouched that will grow in the background until traditional retirement age (Coast FI I guess). While regular old FIRE is our cup of tea, it doesn’t work for everyone, and I think a simpler illustration like that can help get people started.

Good stuff!

Pingback:The Magic of Compound Interest, Revealed! - Physician on FIRE

Pingback:Bad Market Returns? Ain't No Problem Here. - We Want Guac

Pingback:A Tale of 3 Early Retirees: Their Ages at Net Worth Milestones - We Want Guac

Pingback:Want to Be Lazy? Then Invest in Your 20s. - We Want Guac