A Tale of 3 Early Retirees: Their Ages at Net Worth Milestones

While I was grabbing this information about early retirees, I was thinking about other words of wisdom. You know what’s funny about idioms and phrases? You can usually find two that completely contradict each other. Looking at them on the surface makes it confusing. Silence might be golden, but it’s the squeaky wheel that gets the grease. Money talks, but talk is cheap. It’s the thought that counts, sure, but don’t forget the road to Hell is paved with good intentions.

Really, the wisdom of a proverb depends highly on the context it’s being placed in. No one piece of wisdom applies equally to every situation. I was thinking of this because there’s another saying that is good to remember in general, but doesn’t apply to my case study today:

Comparison is the thief of joy.

This is a saying that’s oft-repeated in the personal finance sphere for very good reason. Everyone is coming in to the money discussion with a unique background of privilege, opportunity, and ambition… or lack thereof. Comparing your starting point to another’s finish line is about as helpful as a Couch to 5k participant racing against an Olympic champion. It’s not only unhelpful, but wildly discouraging. Finance-wise, it leaves several folks to throw their hands up, spread their anger and resentment to others, and declare it utterly worthless instead of finding what best applies to them.

However, in my case comparison is very helpful in a narrow context. I’ve noticed those that choose to retire in their 30s were, at one point, like me: in their 20s, building their wealth, planning for a specific future of abundance. Comparing my current net worth progression to theirs helps me a lot in seeing how long it took others to hit net worth milestones when they were my age. It also helps to settle my impatience in just reaching my end goal already; I admire these people greatly, so if it took them several years to accomplish their goals then I don’t feel as frustrated it’s taking several years to accomplish mine.

I’ve had this information written out for months now as a reference for myself and myself only. But why not make it an article so everyone else can reference it, too?

Data Nuance

So here I’ll provide a comparison between three prominent early retirees in the FIRE movement, all of whom retired from work while in their 30s. One is a married couple who worked together to achieve their FIRE goal. One similarly worked with their spouse and has since divorced. The last one does not count their partner’s income and investments as part of their own. One is white, one is Asian, one is Black. Two held engineering careers, while one was in marketing (like me).

It’s also important to note that none of these three had student loan debt, which was significant in hitting these numbers earlier. No substantial healthcare issues with any of them, either, which is a serious hurdle in this country. And all are college-educated, which certainly makes white collar incomes more in reach.

Maybe you have a good idea of who these three are already!

Early Retirees #1: Mr. Money Mustache

Arguably the most recognizable personality in the FIRE movement, MMM (aka Pete) lives in Colorado and became one of our early retirees just ten years after graduating college. His passions include healthy living and DIY work, which dovetail nicely with his other passion in frugality. All those rides on a bike instead of in motorized living rooms (which we know as “cars”) sure do fatten your wallet as much as it slims your torso, huh?

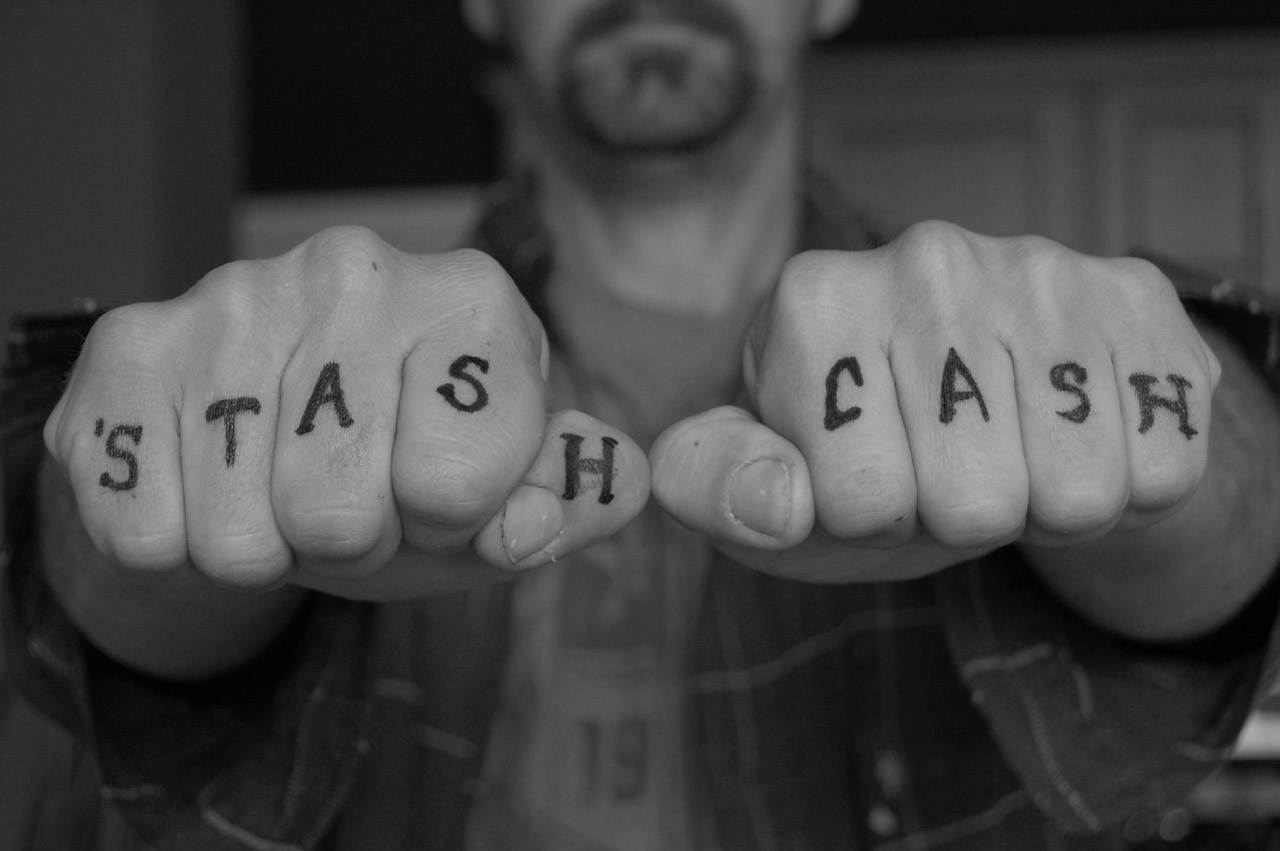

The Mr. Money Mustache stats here come from his 2011 article on “a brief history of the ‘stash”. It’s hard to quantify how much his partner moved the needle here, so I added an asterisk where appropriate.

- Blog Name: Mr. Money Mustache

- Age When Retired: 31

- Investment Mix: Mostly index funds, some real estate

| Year | Age | Net Worth (rounded) | Income (rounded) | Milestone Reached |

| 1997 | 22 | $0 | $41k | WorthlessFI |

| 1998 | 23 | $5,000 | $58k | BabyFI |

| 1999 | 24 | $23,000 | $58k | VacayFI |

| 2000 | 25 | $67,000 | $77k | FoodieFI |

| 2001* | 26 | $150,000 | $127k | BallerFI |

| 2002 | 27 | $250,000 | $160k | HustlerFI |

| 2003 | 28 | $365,000 | $167k (estimate) | SweetSpotFI |

| 2004 | 29 | $490,000 | $167k (estimate) | BlazeItFI |

| 2005 | 30 | $600,000 | $150k | LeanMeanFI |

| 2006 | 31 | $720,000 | $110k | |

| 2007 | 32 | $800,000 | N/A | FoggFI |

*Year wife joined him in CO. This is the year he got a $6k raise and his wife got a job at $44k. This means the total household income went from $77k to $127k – an eye-popping jump.

MMM notes that he and his wife declared themselves early retirees in Year 9 (or 2006 here). Their expenses have been famously low at $25k a year in the 2010s, so that amount still tracks with the 4% rule. Safe to say they had a million by the time the first blog post came along, which snowballed into much more thanks to high blog income.

Darcy’s Takeaway:

It’s fascinating to see the leap in net worth between 2000 and 2001, as that’s when the stock market had a huge bust. The 2008 recession didn’t hurt them much either; in MMM’s words, their lifestyle “barely took a hit” at this time and quickly rebounded. It’s nice to see proof that big market crashes don’t strictly translate to gloom-n-doom.

Early Retirees #2: FIRECracker and Wanderer

Millennial Revolution is run by Canadian couple FIRECracker and Wanderer (or Kristy and Bryce, if you’ve picked up their book). They quit hateful engineering jobs in their early 30s to become early retirees and travel the world. I first loved their blog for their cost breakdowns of each place they visited throughout Europe and Asia. But their writing covers so much more than that, especially when it comes to railing against high home ownership prices (don’t be a home boner!) and one of the most thoughtful strategies to early retirement I’ve seen yet.

The Millennial Revolution stats here come from their 5-part series “How We Got Here”. Part 1 is here, and each part comes with specific numbers on their spending and net worth for each year. I love how thorough the data is!

- Blog Name: Millennial Revolution

- Age When Retired: 31

- Investment Mix: A 60/40 mix with 60% equities (aka, stock market index funds) and 40% bonds, subject to change. Absolutely zero real estate.

| Year | Age | Net Worth (rounded) | Income (rounded) | Milestone Reached |

| 2006 | 22 | $34,500 ($17k per person) | $67k (combined) | BennyFI |

| 2007 | 23 | $108,500 | $125k | BallerFI |

| 2008 | 24 | $135,000 | $131k | |

| 2009 | 25 | $280,000 | $136k | QuarterFI |

| 2010 | 26 | $380,000 | $145k | SweetSpotFI/almost BeachFI |

| 2011 | 27 | $500,000 | $168k | NewGrindFI |

| 2012 | 28 | $655,000 | $169k | LeanMeanFI |

| 2013 | 29 | $832,000 | $155k | FoggFI |

| 2014 | 30 | $1,000,000 | $164k | GoldFI |

They were early retirees in 2015 with that million, which grew to $1.25 million in just 2.5 years. As of 2021, their net worth was at $1.8 million. Give it two years and I won’t be surprised to see them become multi-millionaires.

Darcy’s Takeaways

Kristy and Bryce are unique in that they created a much more conservative portfolio than you generally see FIRE folks do. My own portfolio only has about $10k in bonds, which is only that high after I bought almost $8k of I-Bonds in the last few months. They wanted their portfolio to be as bullet-proof as possible, hence the high bond allocation. They also took it a step farther and added both a cash cushion and a Yield Shield to their investment plan. I’m definitely going to be studying their articles discussing this once I’m ready to take the retirement leap myself.

I think it’s also important to reiterate those income numbers are their after-tax incomes, but for BOTH of them. If you average it out, they each earned about $70k per year. If they were in the US and maxing out their HSA and 401(k) investment accounts, their pre-tax salary would be in the mid-80s. Higher than average, but much more in reach than six figure jobs.

Early Retirees #3: Purple

Last but not least is a graceful lady with a septum piercing and bright purple tresses. She is Purple from A Purple Life, who enacted major life changes in her 20s in the name of reaching financial independence. Said changes included transitioning from an advertising career into marketing and moving across the country to cut her expenses in half (New York to Seattle FTW). Her record-low annual expenses at $20k enabled her to declare she’d join the early retirees at 30 with a portfolio of $500k. And what do you know, she did it too!

The Purple Life stats here come from her “The Numbers” page and her series “$5k to Retirement in 9 Years”. Part 1 of that series is here.

- Blog Name: A Purple Life

- Age When Retired: 30

- Investment Mix: 100% stock market index funds, not including cash reserves for 2 years of spending

| Year | Age | Net Worth (rounded) | Income (rounded) | Milestone Reached |

| 2011 | 21 | $5,000 | N/A | BabyFI |

| 2012 | 22 | $20,000 | $35k | GreenFI |

| 2013 | 23 | $29,000 | $48k | (almost) BennyFI |

| 2014 | 24 | $53,000 | $65k | VacayFI |

| 2015 | 25 | $89,000 | $68k | FoodieFI |

| 2016 | 26 | $137,000 | $85k | BallerFI |

| 2017 | 27 | $234,000 | $103k | DemonFI |

| 2018 | 28 | $280,000 | $107k | (almost) BonJoviFI |

| 2019 | 29 | $448,000 | $110k | BeachFI, BlazeItFI |

| 2020 | 30 | $540,000 | $114k | NewGrindFI |

Purple was the only one on this list whose writing I found before she was an early retiree. It almost felt like I had front row seats to her planning around the hell that 2020 brought us. Her net worth dropped into the 300s that year and had multiple readers questioning if she could still manage retiring. She stayed the course, which turned out excellently for her: her net worth surpassed her $500k goal by her final work day and hit $600k that December. June 2021 had her hit yet another milestone at $700k, which has gyrated between $755k and $650k from December 2021 to today.

Darcy’s Takeaways

I am forever jealous. Data-wise, it’s amazing to see how much more money she gained thanks to compound interest in her late 20s. She reached $100k in 2016, then quintupled that in four years’ time. She also didn’t hit the ground running at first in terms of investing OR salary; it took a few years until she jumped on the FIRE train, but that still didn’t mean forever sacrificing hitting FI in her 30s.

What I find most fascinating is how all 3 of these cases saw their net worth reach at least $500,000 when they were 30 years old. Per person, you could argue the “lowest” amount was from MMM at $300k per person. And this is where my idiom notes at the beginning start to make sense. I’m just shy of a $300,000 net worth at the time of this writing, which tells me I’m on the same track all 3 of them once were. I don’t get anxious about my net worth growth, but I do get antsy when I run into problems at work and think “man, if only I could just quit immediately and never deal with this again”. Patience is a virtue, I guess, even if fortune favors the bold 😉

BEFORE You Say “I Can’t Do the Same”

It was important to me to note at the start how none of these 3 early retirees had significant college debt. A huge chunk of people who graduate college do so with debt; the Class of 2019 alone saw almost two thirds of its graduates with student loan debt. This debt might be the #1 barrier to financial independence for Millennials and Gen Z. It’s totally understandable to feel like you can’t do the same as they did with that albatross around your neck.

Let me be clear: having a setback like debt makes building wealth harder. It does not make it impossible. You can still reach significant wealth with student loan debt, which I count as reaching six figures before you’re 30 years old. You can do this on an average salary, too. It’s going to be harder, but still very much possible.

I have the numbers to back me up on why reaching that number is so important. If you hit $100k wealth by the time you’re 30 years old, you can reasonably expect to reach an $800k net worth by the time you’re 60 years old… and that’s without saving/investing a single penny more, thanks to compound interest. If stock market returns are less than their historical averages, you’re still coming out far, far ahead; I’ve mapped out several scenarios showing off the differences once you hit that six figure milestone.

After you hit six figures, the most minimal efforts after that are cake.

If you decide to invest a measly $1,000 each year after your 30th birthday, you’ll be a millionaire in your mid-50s with that $100k starting balance. While you won’t be in your 30s, you’ll still be one of the early retirees at that age. Then you’ll celebrate your 60th birthday with almost TWO million dollars at your disposal.

| Net worth | Age |

| 100,000 | 30 |

| 111,000 | 31 |

| 123,100 | 32 |

| 136,410 | 33 |

| 151,051 | 34 |

| 167,156 | 35 |

| 184,872 | 36 |

| 204,359 | 37 |

| 225,795 | 38 |

| 249,374 | 39 |

| 275,312 | 40 |

| 303,843 | 41 |

| 335,227 | 42 |

| 369,750 | 43 |

| 407,725 | 44 |

| 449,497 | 45 |

| 495,447 | 46 |

| 545,992 | 47 |

| 601,591 | 48 |

| 662,750 | 49 |

| 730,025 | 50 |

| 804,027 | 51 |

| 885,430 | 52 |

| 974,973 | 53 |

| 1,073,471 | 54 |

| 1,181,818 | 55 |

| 1,300,999 | 56 |

| 1,432,099 | 57 |

| 1,576,309 | 58 |

| 1,734,940 | 59 |

| 1,909,434 | 60 |

Doing this is much easier to talk about than actually implement, don’t get me wrong. It’s a bitch to grind it out now in our 20s. We want the grace to figure things out, make mistakes, get messy. In this case, you have to pick. Do you want grace and a sad bank account, or do you want to be a graceless weirdo with fat ass stacks? Refusing to pick defaults you to Option 1. Choosing Option 2 means you’re buckling in for some more grinding than you may have first expected. So choose the best you can, starting wherever you are. And choose wisely, whether it seems contradictory or not.

Cover image credit: Tetiana Shyshkina via Unsplash

Great concept for a post! What an interesting comparison.

When your income gets close to or exceeds six figures, I think you have a lot of options and opportunities to ramp up investments. We’ve just now hit that mark, which makes shuffling money into our 401ks and IRAs much less painful than in previous years. We’re late to the game but I’m still hopeful we can secure a decent retirement. Seeing these folks’ progress is motivating.

Thanks friend! Reaching a six figure income is a game changer for the household, doesn’t matter whether you’re single or partnered. Makes things much less painful, indeed 🙂

Wife and I (both 37) are at nearly 1.1 million, though real estate is ~600k of that. If we don’t count our primary equity, we are near 820k. I feel nowhere close to retirement so this is encouraging to read and remotivates me to pursue this aggressively.

Stocks since November have been terrible on our portfolio though.

I’m glad this helped! It’s helped me for months now to look back at their progress and see I’m at roughly the same place they were in their late 20s. It’s a nice feeling.

Also: FEEL YOU on the stocks. They won’t always go up so I knew this was coming, it’s just very annoying when I was so close to hitting a net worth milestone.