SWR (Safe Withdrawal Rate) for Dummies

The financial independence movement (FIRE) almost doesn’t need much to be marketed; its basics are a siren song for the overworked masses in America already. With simple lifestyle changes that will NOT have you eating lentils garbage under a bridge, you can have so much money you will never HAVE to work another day in your life ever again! Of course, there’s some new budgets to implement and investing terms like “SWR” and “S&P” to understand, but hey! It actually is not a scam – you can get all the guidance you need for the price of free – nor a supervillain-backed conspiracy.

What it is, at the end of the day, is unconventional. One of the biggest hurdles to reaching financial independence is gaining financial literacy, which remains one of the most elusive skills for Americans at large. What helps bring you up to speed with FIRE is not just understanding how you can reach it yourself. It’s also about what to do with that money once you reach it, the “Now what?” question after hitting any other goal in life. To understand that, let’s take a look at safe withdrawal rates (or SWR) to get more confident with all these financial shenanigans my corner of the Internet is up to.

Understand the SWR Basics

The idea behind a safe withdrawal rate is primarily about what it says on the tin: safety. Ideally you have enough money invested so that you can take out what you need to spend as per your budget each year. Couple this data with the average market growth data to reach a place where you won’t run out of money for the rest of your life. This assumes that money is invested in an index fund tracking much of the stock market, such as a total market index fund or an S&P 500 index fund.

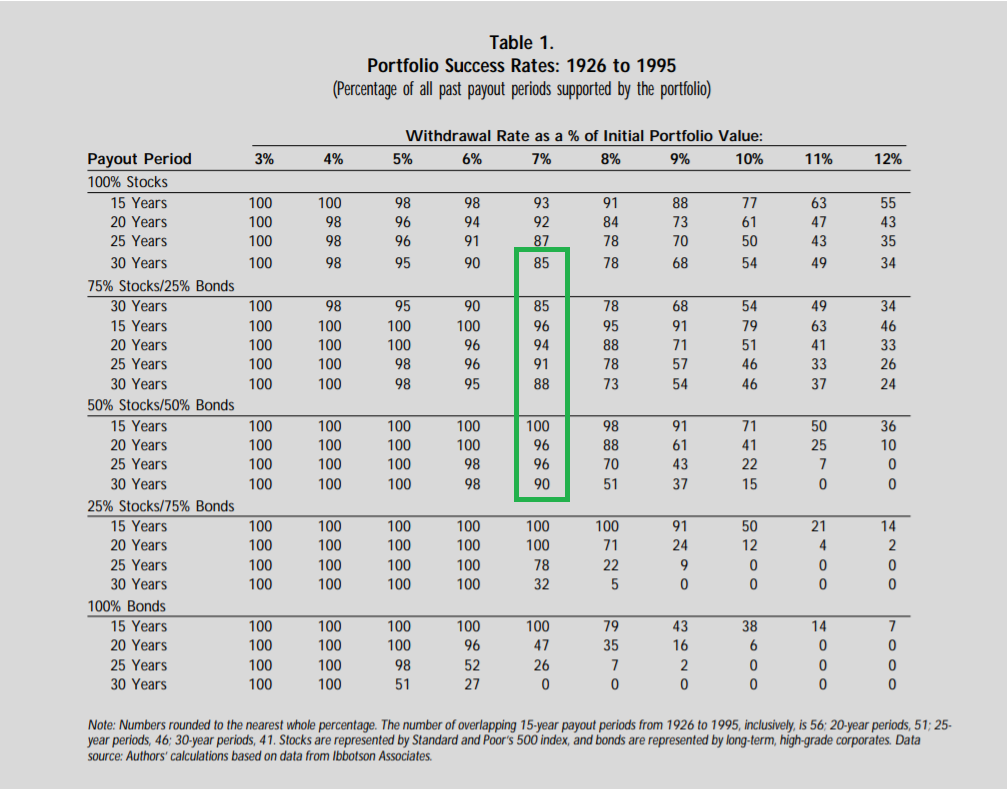

The question generally becomes “How much can I safely take out each year?” which is hotly debated. The usual rule of thumb is 4% based on historical average growth rates of 10%. Sometimes the stock market returns 25%, sometimes it returns negatives. Overall it shakes out to that double-digit percentage, which explains the ten. The four comes from the Trinity Study, an academic research paper published in 1998 by three finance professors at Trinity University. You can read that paper here; it’s a fairly quick six-page overview.

If that’s still tl;dr: they weighed inflation and historical periods against investment portfolios with stocks and bonds. As a result, they concluded “highly conservative” 3 to 4 percent withdrawals make it “extremely unlikely” to run out of money. Your chances of success will vary depending on how much of your investments include stocks and bonds; that 3-4% is also referencing the portfolio value AT THE START, not on the portfolio value of that specific year. If you start taking money from your portfolio in 2021 AND you’re still taking money out in 2031, you’ll want to withdraw 4% of the 2021 value while in the year 2031.

Digging a Little Deeper

The Trinity findings also assume investments will provide money for no more than 30 years. That’d be fine enough for the average 65-year-old retiree; thirty more years puts them at 95 and only optimists plan for longer. For those of us who would like to use that money for longer periods of time, i.e. earlier in life, the rules are different.

Personally, I don’t plan to hit my FIRE number anyway until my mid-30s. That number (a cool million) is assuming I’ll only need to withdraw $30k each year (or 3% of that starting value). However, I chose that number based on how much I spend and figuring out what that $30k is 3% of. What if I didn’t have to wait until I reached a million? Would I still be okay if I had a higher withdrawal rate? Because if I could, that’d mean I could reach my FIRE number even earlier.

The Trinity Study’s first table says I could go up to a 7% withdrawal rate and STILL have high chances of never going broke. Hot dog, it pays to understand SWR math!

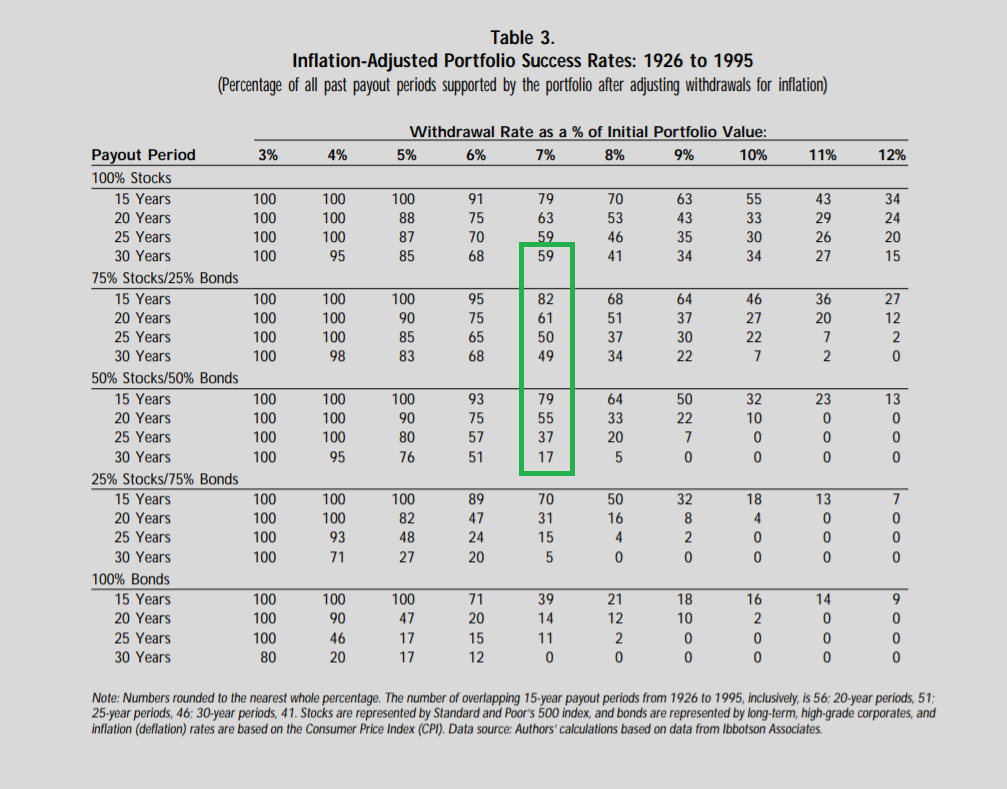

That is, however, without adding inflation to the equation. Once you do, it’s considerably less sexy.

Even with the not-so-exciting numbers, the odds are still in your favor to bump up the withdrawal rate to 5%. In my case, that would mean I’d only have to reach $600,000 in investments instead of $1,000,000. That could mean reaching financial independence in my early 30s instead of later in that decade, taking back multiple years of my adult life. For folks less fortunate than I am that’s even better news; if someone out there is saving a lot less, they’d still have a decent shot at a long retirement.

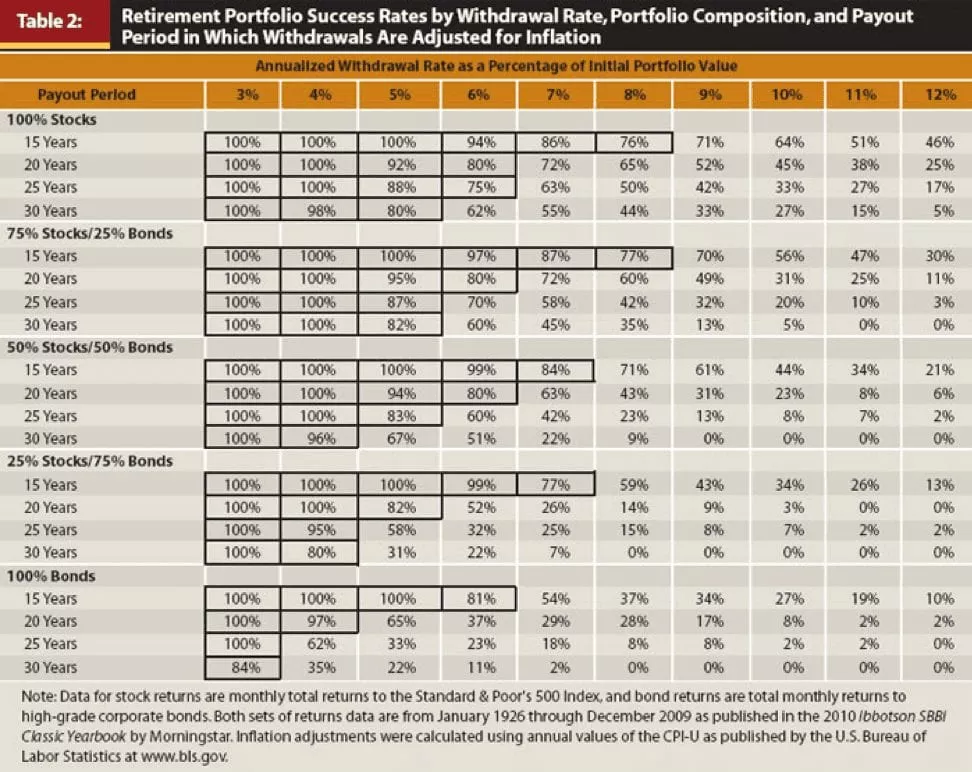

Updates to the Trinity Study

So, promising. The original researchers even updated their findings in 2010, showing similar numbers despite the dotcom bust and 2008 recession.

Interestingly, the researchers (Drs. Cooley, Hubbard, and Walz) let us know you should be good with anything higher than a 75% chance of success. (Not what the American grading system would have told me, but I digress.) That means anything with a 75% chance of success or higher is so good that this is what “most practitioners and clients” should aim for. Given that these averages do NOT include the longest bull run in history (2009-2020) it seems a good number to shoot for…

… when it’s not YOUR life. 75% chance of success might look neat in an ivory tower, but if you’re more at sea level you might want a little more assurance than a C grade can give you. The FIRE movement has got a lot of great calculators to give you more insights into this stuff, so let’s use some of those and make my case study a little more personal.

To do that I’ll be using FIRECalc, which looks at 121 spending cycles to generate how your portfolio – and spending – would fare. If you go to that page and navigate to the “Start Here” box, you can start playing around with the numbers, which includes for how many years you’d plan to use your portfolio for. In other words, looking at periods longer than 30 years, if you so wish!

The 4% Rule is a Rule OF THUMB

That rule of thumb is excellent for a two-second check on how much money you’ll need. Speaking of rule of thumb, did you know that phrase was around as early as the 1600s? “Rule of thumb” came about from the tradespeople of olde, who used their thumb to measure an inch while hemming clothes or brewing beer. It’s super neat and handy when you don’t have precise tools to tell you what you need, which relates exactly to the usefulness of 4%. It’s meant to be a rule of thumb, not a sacred law of the cosmic universe. The right SWR for you is going to be in the realm of 4%. It up to you to understand what specific SWR is going to work for your needs.

One of the most important variables is the length of time you’re expecting your portfolio to cover. A somewhat (very) morbid consideration in the best of times, since you can assume you’ll want your portfolio to last until the day you die.

30 Year SWR Estimates

I can use a few fast calculations to understand my SWR with tools like FIRECalc to help me out. Gauging my basic chances of success are pretty straightforward based on historical returns; FIRECalc maps out 121 periods with the data we have to see how you’d fare with your amounts at any 30-year points in history. Basically, I calculated what the overall portfolio value would be if the funds I’m withdrawing equals $30,000; the equation looks like this:

X% of Y = 30,000

If I add 10 for X, I find out Y=$300,000. If X is 9, Y is $333,333.33. You can find this out yourself by taking your estimated yearly expenses and dividing them by the withdrawal rate percentage. (Example: if your expenses are $40k and you want a 5% withdrawal rate, input “40000 / 0.05” in your calculator. That shows you the portfolio should be $800,000, since 5% of $800,000 is $40,000.)

Here’s what I find in my quest to understand the SWR for me:

| Withdrawal Rate | Chance of Success |

| 10% | 2% |

| 9% | 6% |

| 8% | 20% |

| 7% | 42% |

| 6% | 52% |

| 5% | 74% |

| 4.5% | 83% |

| 4% | 95% |

| 3.6% | 99.2% |

| 3% | 100% |

These super basic numbers are pretty nice and promising. 95% is an overwhelmingly positive number. If I had a 95% chance of winning the Boston Marathon or visiting the moon, you’d see me immediately leaving my apartment to sprint to Cape Canaveral. 95% is good. 5% is still a risk, but a small one in the grand scheme o’life. That 5% is exactly why it’s “the 4% rule”. The odds are so heavily in your favor you leave Effie Trinket gagging. Stick it to the Capitol and ride away from corporate America into the sunset, is what reaching 4% can tell you.

50 Year SWR Estimates

As mentioned above, wanting your portfolio to last for 30 years works if you’re retiring/no longer working for money starting in your mid-60s. If you want to reach financial independence before your 60s, that’s another story. If you’re projecting to reach FIRE in your mid-thirties, you’ll want a portfolio that works for much longer. Below are my FIRECalc results after inputting the data to accommodate 50 years instead of 30:

| Withdrawal Rate | Chance of Success |

| 10% | 0% |

| 9% | 1% |

| 8% | 3% |

| 7% | 17% |

| 6% | 32% |

| 5% | 48% |

| 4.5% | 63% |

| 4% | 77% |

| 3.6% | 93% |

| 3% | 100% |

Remember that school grade talk? Because most of these percentages are not about to pass this class.

This is why rules-of-thumb like the 4% rule need a second glance in your personal circumstances. They’re awesome to use as a baseline and to get an idea of what’s necessary; it’s up to you to see what will work best in your case.

More SWR Variables

But! This doesn’t take into account Social Security, which, at the earliest, will kick in at age 62 (or in 35 years for moi). That takes some of the pressure off my portfolio and makes my success rate somewhere in between the two above. The Social Security calculator I used estimates I’d receive at least $2k per month, or $24k a year. That means that, as long as I have $200k in my portfolio, it’s smooth sailing for me.

But!! This doesn’t take into account UNEXPECTED expenses. What if THE WORST were to happen?!! Become quadriplegic? Develop a chronic disorder? Suffer lifelong complications from some new-to-me disability?

That is a fantastic question, because my budget doesn’t include those things. Neither does my current budget. I have no idea what unexpected expenses might be in my future because they’re unexpected. Without my savings and investments, I’d have drastically few resources should they come up. Since we can’t know if the expenses will appear, we can’t exactly sign a specific dollar figure to them, either.

To understand what’s your ideal SWR, including that unexpected, research is your friend.

Instead of arbitrarily picking a number from thin air, I look at how much adults in general spend. Unless a freak accident or serious medical diagnosis crops up between now and my 60s, I stand an excellent chance of not having huge unexpected expenses related to that. This is doubly so if I don’t have dependents in that time; since I don’t plan on birthing children and am estranged from most family, this doesn’t seem likely. It’s when I’m in my 60s and older that age-related issues start coming in full-force; needing specific prescriptions or mobility aids might be my unescapable reality then.

Or maybe not: much of it is based on genetics and I am well aware of what the last few decades of my grandparents’ lives looked like. Three of them lived until their late 80s/early 90s, despite all four having some pretty rough childhoods and decades of smoking to boot (they thought it was healthy). My life’s had a lot less turmoil, comparatively, and definitely has much better medical advancements. Genetics-wise, at least, I should be in good shape.

Besides, if something does happen that makes me unable to stick with my projected expenses, I’d be in a much better position to deal with them than if I had much less to my name. Having a dollar in my pocket will do me good if life punches me in the mouth.

Risk Tolerance

Ultimately, understand your SWR has everything to do with your risk tolerance. In the investing world, “risk tolerance” refers to how much risk you can stomach for higher returns. Bonds are guaranteed returns at lower rates; stocks are less guaranteed, but offer much higher returns. In the financial independence world, risk tolerance has everything to do with how much risk you can stomach with the money you live off of. If you feel confident enough to use a 7% withdrawal rate or higher? Well, that’s up to you. If you will accept nothing but a sub-3% withdrawal rate? Again, it’s up to you. It’s your money, your decisions, and your life. As such, you’re the final decision-maker on your financial actions. Do what you’re most comfortable with, as long as you thoroughly assess your withdrawal risk tolerance and what you’re most comfortable with.

I’ll give some extreme examples to better illustrate my point. Two people are looking at that 50 years’ estimate table from FireCalc and have extreme opinions on it. Person A happens to feel outrageously self-assured about going for the 8% withdrawal rate, because they have reason to believe that super-low chance of success will work in their favor. Person B feels differently. They will only feel secure if they are at a 2% withdrawal rate, preferably 1% if they can hack it. Why? Because they will only approach the outrageous self-assurance of Person A if they overcorrect for that 100% chance of success.

You, my friend, get the honor of choosing this for yourself. Persons A and B are extreme ends of the SWR spectrum; I’d very much suggest you follow in neither of their footsteps, forging your own choice instead.

The Terror of Responsibility

There’s admittedly quite a bit of nuance to this strategy, as withdrawal rates depend on many more factors like:

- Will your portfolio be 100% stocks? A mix of stocks and bonds? Some other assets entirely?

- What’s your risk tolerance?

- What will you do if you’re hit with large unexpected expenses?

- Is Social Security part of your strategy?

- Are you expecting windfalls, like an inheritance, to help you?

- What if the coming decades have different returns than what we can best guess?

- Is there flexibility to your withdrawal strategy?

- What’s your plan to mitigate sequence-of-return risk?

- Are you putting safety buffers in place, like a cash cushion or “Yield Shield”?

It should be a well thought-out decision so blindly wandering into it. That’s the way it is with every other significant aspect of your life. You should have a long list of questions-and-answers for how well your career fits you, how compatible you are with your significant other(s), and your level of comfort/peace with the religion you’re aligned with.

ALL OF THESE involve hard truths and hard work to sort out. Finances are the exact opposite of an exception here. The 4% rule is, again, a rule of thumb; it can give you a decent idea of what you should aim for, but it’s up to you using research and tools to get the exact measurement. Daunting? Yes. Does it make the concept of financial independence clear? Also yes. Will it help make money seem less scary? HELL TO THE YES. Money is so overwhelming and petrifying specifically because you don’t know enough about it. Once you start to demystify and understand financial terms like SWR, life becomes that much more manageable.

Cover image credit: Natalia Mok via Unsplash

Darcy, that’s more like the 4% rule for smart people, great job you did there! And Social Security will drop our withdrawal rate to 1% in four years when we start drawing it. I never used to think it would amount to much but its a much better payout than I expected.

Pingback:Let’s Talk Dividend Stock. WTF Is That and Should I Invest in Them? - We Want Guac

Pingback:A Tale of 3 Early Retirees: Their Ages at Net Worth Milestones - We Want Guac

Pingback:A $300,000 Update: We Want Guac Turns 3! - We Want Guac