The Perfect and Sexy Power of Some

I was thinking about “the power of some” over the last week or two. I’ve got a lot on my plate already without adding household chores to the pile. Laundry, dishes, sweeping, tidying up, organizing bills, grocery shopping, and all the other household things won’t do themselves. Can’t foist some responsibility off of someone else, either, since I 1. Live alone, and 2. Don’t feel all that comfortable hiring a cleaner in a pandemic. This means my busyness leaves things not done; I’ve definitely put off stuff like dusting and vacuuming, for example, and my socks really need to find a way back into their sock drawer home.

Ultimately, I know I don’t have the time and mental resources to knock everything off my list in ten seconds. The Big Comfy Couch lied to me. HOW COULD YOU, LOONETTE.

Instead, I have embraced the power of some. Getting some of this stuff done is better than avoiding it altogether. That way, I can at least maintain a level of cleanliness up to standard. While it’s not spotless, it’s nonetheless an organized, comfortable, and relaxing space.

Some is leagues better than none. There is power in getting some done; life really isn’t about all-or-nothing except in pretty infrequent, unique circumstances. And there’s no area of your life that benefits more from “the power of some” than your finances.

The Power of Some in Practice

This is really important for those who admire the extreme financial examples in the media. I’m talking the couples who become millionaires seemingly overnight, or the guys with big salaries that boast a 90% savings rate. When you dig into their stories, you often find they:

- leave out a LOT of detail as to how they did this

- come from an uber-rich family that gave them the bulk of their money

- did something risky with a low chance of success and become one of those lucky few who make it

- have access to time, energy, and resources you can’t hope to, or

- do actually-very-crazy things like live with 5 other adults in one apartment, eat only the leftovers from their restaurant job, and see nothing wrong with riding your bike through literal snow drifts*

Yeah, this can get real demoralizing, real quick.

But these people aren’t the only ones with big financial wins. I mean, you know this if you’re reading this blog: there are several diverse individuals who made it after starting from the same point you’re at right now. Maybe you look at their strategies and think “but I can’t possibly do all of that”. If so, good on you for approaching this with a critical eye! Blindly accepting whatever you’re told is how we ended up with much of the evil in the world. You’ll want to think through what you’re told.

But don’t for a second think you have to fulfill every piece of financial advice punted your way. Not only because a lot of it can be contradictory (Credit cards are evil! No they’re not! All debt is bad! Some debt is good! We are human! Or, are we dancer!)

…it’s also not coming with the benefit of your personal perspective. Opening multiple credit cards might be phenomenal for you if you can earn all those rewards; it’s not so great if you don’t think through your spending and quickly go into consumer debt. It’s good to accept you can’t perfectly emulate every single little variable another has on their separate path to financial success.

Instead, you should remember the power of some. Doing some of those things will still help you out a lot more than staying stagnant would. Maybe you can’t actually do everything they did. But you can do some of it. Doesn’t have to be a big “some,” either. Maybe you can’t swing the six figure income yet, but can you start to budget? Learn about investment accounts? Build a profitable skill set? Doing some of it is going to leave you so much better off than doing none of it.

You Can’t Go Full Hog at the Start, Anyway

My writing’s geared towards those still in their 20s. Almost by definition, that makes us all beginners in this highly complicated and nuanced financial system. Let alone, the world that encompasses said financial system.

So save yourself the stress of doing it all immediately after collecting your diploma and just do some! I officially give you permission to shed the school-age belief that you are not allowed to only do some of what is expected of you. I’m not going to make you feel bad about doing only some of your homework or saying hi to some of your relatives at the family reunion. Life is harsh and cruel, but you’d be surprised at how forgiving it can be, too. You are not going to ruin your life if you cannot muster up the energy to be like the Joneses.

So don’t feel like you HAVE to start off in the deep end when you’ve never swam much before. That’s intense as hell. Start off in the shallow end, get used to the temperature, and take it easy. Hell, chill in the kiddie pool for a bit if that’s more your speed. It’s got those funky mushroom waterfall trees! Or sprinklers!!

Finances are arguably the most important aspect of life you need to learn. It’s also just one of the many varied aspects you must learn in order to be a functional adult in the 21st century. With whatever you still need to add to your tool belt, use the power of some to get at least some of it out of the way. Grant yourself permission to just do some of it if you find you can’t do all of it. This isn’t a fatal character flaw, friend. It just means you’re going at your own pace.

“Some” Today is More Powerful than “All” Tomorrow

The younger you are, the more powerful “some” is. It’s hard to find a better financial example than you do in compound interest. If you invest some money before you hit 30, that some be just as powerful as “all-in” for someone much older.

How? Because the earlier you start investing in something like index funds, the more money you’ll end up with. I’ve seen that in action years ago with my own money. And many solid finance 101 courses out there show the same, like this one courtesy of University of Idaho:

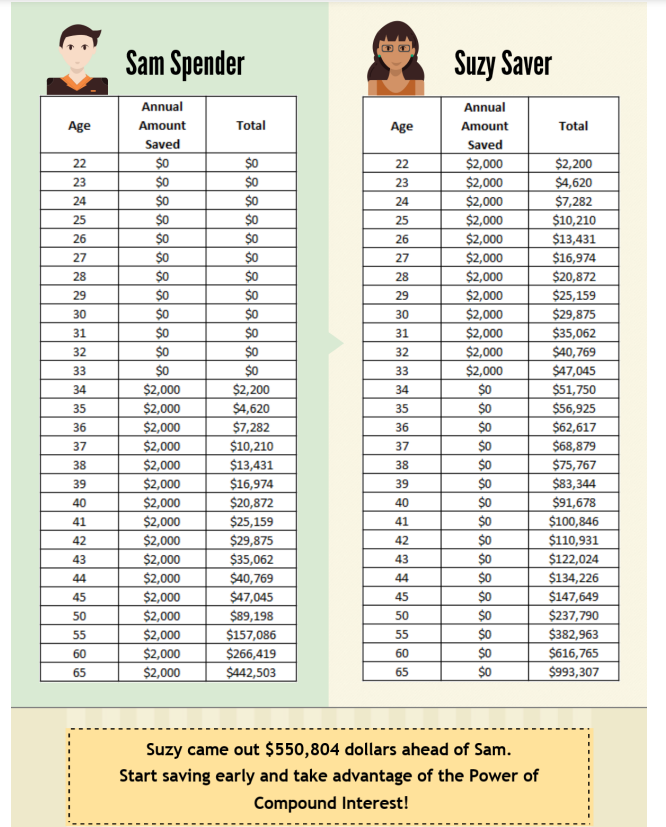

Sam and Suzy both learned at a young age they needed to save for the future. During college, Suzy put money aside in a tax-deferred investment fund. Due to life events Suzy stops saving after the age of 33. Sam started saving later in life. He started to get serious about investing at the age of 34. Sam and Suzy compared their investment accounts at retirement. Suzy invested a total of $24,000 over 12 years, while Sam invested a total of $64,000 over 32 years.

Suzy didn’t invest much at all in the grand scheme of things. She also didn’t keep adding money to her investments throughout her working career. She wasn’t like Sam, who chose to funnel 20 years more of savings into an investment account. Instead, she chose the power of some. And because she did it early on, she ended up with more than double the money Sam did.

The power of some strikes again.

In Suzy’s case, the power of some left her practically a millionaire. That “due to life events” that makes her stop investing? It can easily be something like:

- A worldwide pandemic dramatically altering everyday life

- A serious illness

- A death in the family

- Wage stagnation, in a time of high price inflation

- Giving birth to, adopting, or fostering a child

The funny thing is, all of these things affected billions over the last two years. That’s with a B, for billions. I’m sure Suzy could have, at some point, started investing again if she so wished. But she never had to in order to secure her financial future. The power of some, executed as early as possible, secured that for her instead.

So be like Suzy. Take advantage of the power of some, whether that’s in your financial life or in your more boring, domestic-household-maintenance life. Either way, you’re doing your future self a massive, massive favor.

*Speaking from experience. Because I actually have done all these things in my life, albeit not all at the same time. Why did I do it? Because I was trying to emulate the extremes of others in the finance space. The savings were not worth the misery. Do Not Recommend.

Cover image credit: Ignacio Correia via Unsplash

I like to say “Anything worth doing is worth doing a half-assed job of.”

Excellent phrase 😉

LOL yes!

Big fan of ‘done beats perfect’ over ‘anything worth doing is worth doing well/perfectly’

It’s good to read this and we should practice sharing this message as much as we can. Early on in the PF world (almost 20 years ago 😬) there were some people who kept whining on every blog that they couldn’t do what everyone ELSE was doing so they’d never make ends meet and everything and everyone was awful for sharing their struggles and successes. I didn’t know their exact circumstances but I couldn’t make all my ends meet either. So I did the best I could to save *something* out of what I had at the time, whatever my circumstances were. Even if it was only a couple quarters, anything I could tuck away was a tiny little victory slowly building up to something real. Eventually, with that habit firmly in place, the momentum picked up when I earned more income and it became noticeable progress.

My boss used to chide me to never let the search for perfection get in the way of the good. I didn’t (want to?) understand what he meant on a professional level but financially, real life constraints meant I had to practice the financial version of that and it really makes sense! Every little bit counts.

It’s not only easy to whine about how something isn’t applicable to your life, it’s self-defeatist. Absolutely no one on the planet is going to go through the exact same experiences you do – not your twin, not your spouse, no one. All you can do is look at what others have done and go “okay, how can I rework something like that into my own life?” Hit the nail on the head as usual, Revanche!

The power of some has been a central tenant of Lazy Man and Money for… well since you 10 years old I guess. (Ouch. I’m really old.) I approach most things with the 80/20 rule in mind. The easiest 80% of something takes 20% of the work. I’ve found that stacking up those twenty percents in a few different areas (money, health, household chores, etc.) add up.

Ooh I love your ultra-strategic approach to the 80/20 rule! Don’t feel too old over there, all it means is you’ve got more experience to assure you you’re right 🙂

Lots of wisdom in the idea of some. I didn’t start out to run marathons. I just wanted to be able to run 2 miles when I started in my thirties to get more fit. But by starting to run a few dozen yards at a time I eventually became a runner. Our finances are similar, we didn’t start out to have millions but by living on less than we earned and saving and investing over a long time we ended up with millions. We didn’t do everything the experts recommend but we did some of them consistently. And it was enough. And if lazy man is old then I’m a fossil.

Pingback:T.G.I.F. Friday: Volume 64 - Accidental Fire

Pingback:A Tale of 3 Early Retirees: Their Ages at Net Worth Milestones - We Want Guac

Pingback:What Is Financial Self-Advocacy? | Debt Free Guys