Lost $50k On Paper (And I’m Doing Just Fine)

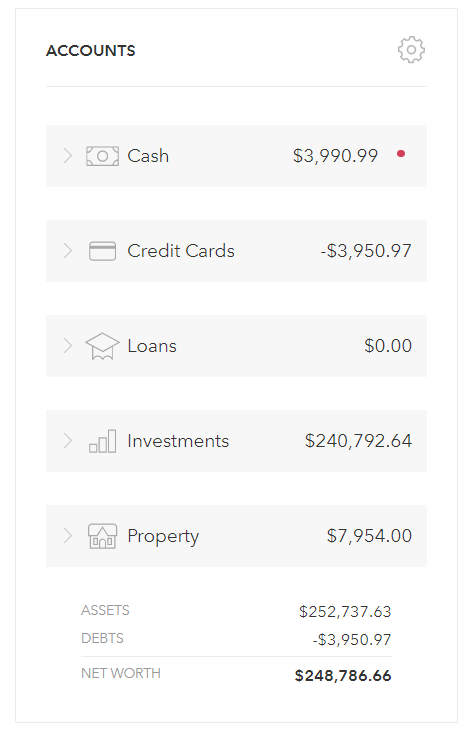

Early April saw my net worth up within kissing distance of $300k. Today, it’s at $248k. This is my new personal record for how much money I’ve lost during market dips ($50k). And the day before I go spend a month in Europe to boot.

There are a lot of nervous investors right now out on the interwebs, fueling rumbles of unease through social media and op-eds. So, it was worth it to do another check-in with myself and where I’m at emotions-wise.

For me, personally, there is zero nervousness or panic of “omg did I just waltz into an epic mistake?” I know I didn’t make a mistake. My strategy – index fund investing in the overall stock market – has worked for investors during the dotcom bust, the 2008 recession, and the initial COVID drop. Future scenarios matching this severity will also likely match the recovery and, therefore, give me more money.

My current emotional state is stress-free. It’s more of a giddy feeling, bizarrely enough. When I saw the 248 on the Mint page, I was gratified to see it finally went below the $250k mark. I’ve been expecting it to fall under 250 for a while, so now that it’s happened I can use the above headline. I think it’s because my brain is rewired to view it as a good buying opportunity for future returns. Think less “this is terrible” and more “hey lookie here, the stock market is on sale!”

The Performance Changes I Now Must Make

Unless I’m mixing metaphors, the traditional advice to new investors in the red is to “tighten your bootstraps” or whatever. You might be considering this if you weren’t an index fund investor or, otherwise, not diversified enough.

I, on the other hand, am doing no tightening. Having lost $50k on paper doesn’t affect my life; it shouldn’t affect the lives of my fellow 20-something investors, either. Whether the stock market goes gangbusters this year or continues into the red, I’ll be doing the same thing either way: sticking to the plan. That plan is simply to continue living life as I have been. Staying productive at work, hanging out with loved ones, spending time on my hobbies, improving my health, and keeping on top of my house chores (ugh, dirty dishes are never-ending). The market being down right now doesn’t matter to me. Because it’s only going to be down for right now. I can get more index fund shares for cheaper right now with the money I was gonna invest anyway; that’s about as much as it changes things for me.

The Stock Market Performance

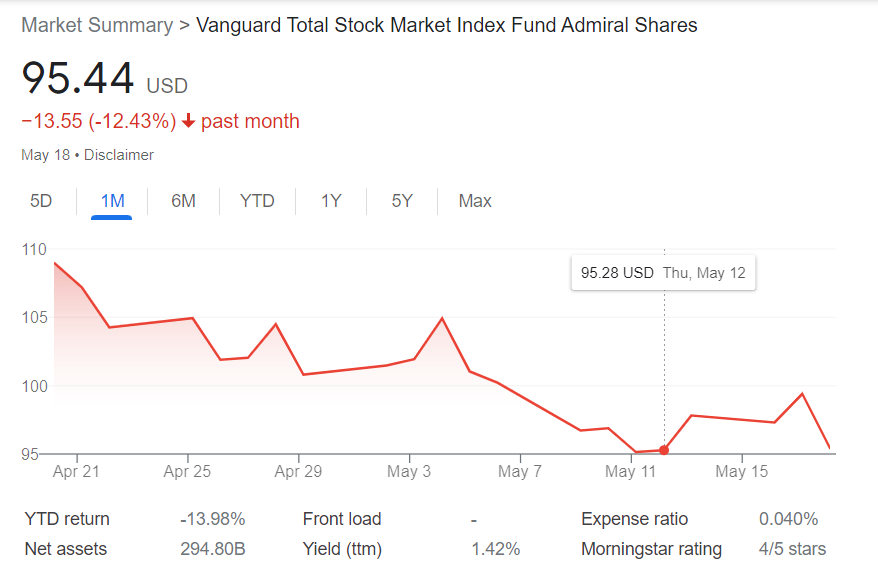

And being down over a six-month period ain’t a new thing for the stock market, either. You can see this easily by Googling the stock market index fund $VTSAX to see what I mean. If you do so, you’ll see this data as the top result:

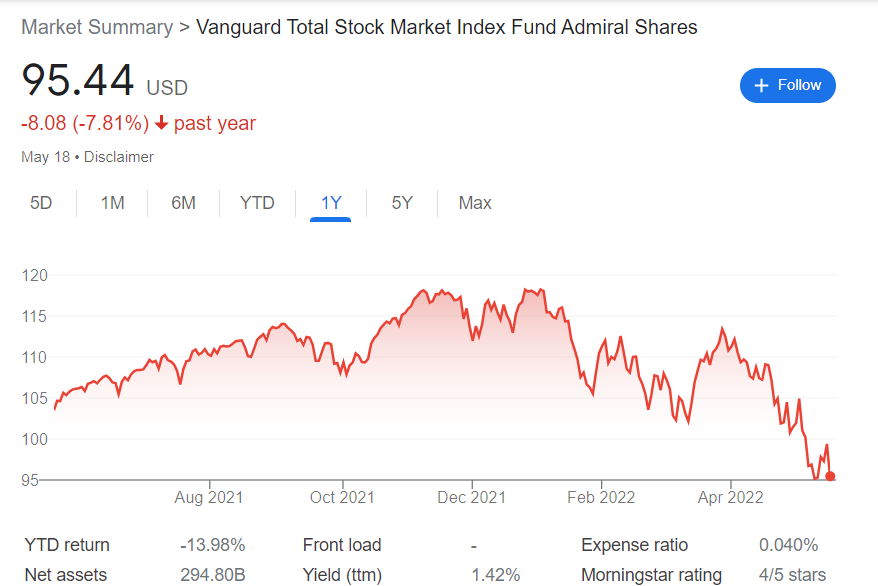

All red, oof. Same red if you make the data go back over the last 6 months, or 1 year, or YTD:

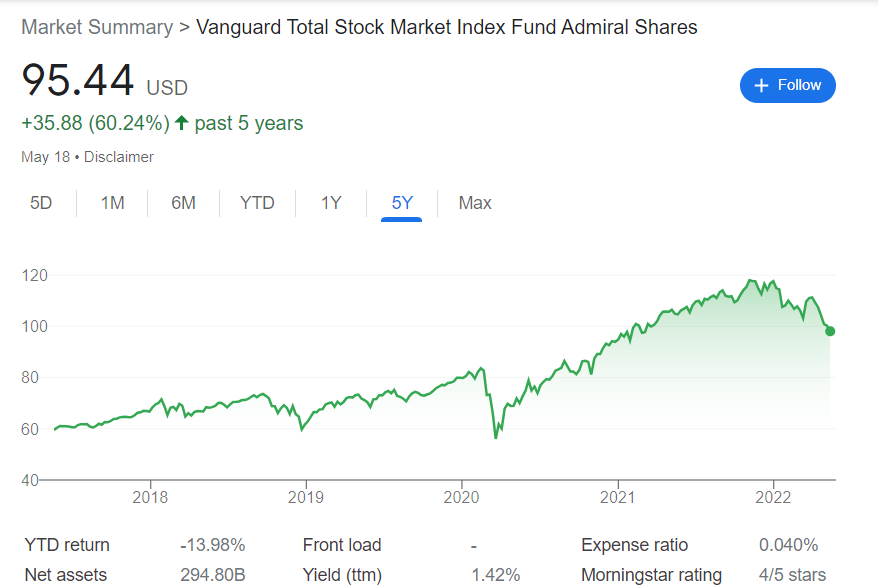

Scary? Cringy? Maybe you’ll feel a little differently by a) remembering we’re investing over several years, not months, and b) looking at the data over the last five years:

I started investing in January 2017. Back then, one share of VTSAX was roughly $59. Today – and that’s the same “today” I mentioned in the first paragraph – the price is $98. Rounded down, that’s a return of 60%. That’s slightly better than the historical average of 10% every year, because I got extra returns on top of what I expected. So what if I lose a little bit of the gravy? It’s all gravy at this point.

I am nowhere near financial independence like most of Gen Z. Since most of Gen Z is nowhere near financial independence, this continued stock market slump is an EXCELLENT opportunity. If you’re just starting out it’s a little unnerving to buy into the storm. It’s very likely you’ll see your investments “lose” money next week or next month. The reason that’s okay is because you’re buying these investments to pay off in another several years. You should only be investing money that you will NOT need to make rent or groceries next month. For short-term needs, you should be relying on your income for regular expenses and your emergency fund for unexpected expenses. The extra is what will bring you lasting wealth.

The Worst Case Scenario

What if this is the start of a prolonged slump like we’ve seen in countries like Japan?! I won’t get into why I seriously doubt that will take place and, instead, focus on what I’d do.

In this case: nothing.

My plans to reach financial independence will be delayed, sure, but not obliterated. At one point, I calculated I’d become a millionaire even if I go with a 0% savings rate for the rest of my career. This is thanks to me beginning investing in my early 20s. Time is on my side. However, that millionaire status hinges on the assumption my index fund investments will grow at the historical average of 10%.

If this is the beginning of some epic slump that will last for decades, I cannot rely on portfolio performance for growth. Instead, I’d have to rely on the amount of money I’m saving from my day job.

Let’s assume I keep on earning a post-tax income of $78,000 and spending $35,000 of that every year. Doing so would leave me with a savings of $43,000 per year. For easy math we’re leaving out any potentially higher expenses; we’re also leaving out any bigger bonuses, raises, and potentially lower expenses. So, when would I become a millionaire if the market forever returns 0%?

| Age | Net Worth |

| 28 | $250,000 |

| 29 | $293,000 |

| 30 | $336,000 |

| 31 | $379,000 |

| 32 | $422,000 |

| 33 | $465,000 |

| 34 | $508,000 |

| 35 | $551,000 |

| 36 | $594,000 |

| 37 | $637,000 |

| 38 | $680,000 |

| 39 | $723,000 |

| 40 | $766,000 |

| 41 | $809,000 |

| 42 | $852,000 |

| 43 | $895,000 |

| 44 | $938,000 |

| 45 | $981,000 |

| 46 | $1,024,000 |

Wouldja look at that. If I both save that $43k and see that earn 10% on average each year, I’ll become a millionaire in my 30s. If I stop saving anything, but still earn a yearly 10%, I’ll become a millionaire in my early 40s. And in the scenario of saving $43k and having that earn a big load of nothing, I’ll become a millionaire in my mid-40s instead. Such woe. How tragic.

Diving into the Numbers After I Lost $50k

Now, spending $35,000 each year off of that million means I can quit my job at 46 and be covered spending-wise for the next 28 years. At Year 21 I’ll become eligible for full Social Security benefits, so I’ve got plenty to cover the gap til then. I don’t include SS benefits in my calculations so it’ll be a nice boost no matter if it’s pared down or not; either way, it’s taking some burden off of my sad portfolio.

So there you have it! Because I started investing in index funds when I was making $40k a year, it’s left me in an excellent financial position. Had I waited to invest until I was making $100k a year, I wouldn’t have had nearly as much money thanks to the growth since 2017. That previous growth is now insulating me while the stock market is consistently negative. Have I watched my investments drop to $50k in the last 5 months? Yep, sure did. But that STILL leaves me with a healthy six figures of wealth and with all of the perks that come with a $200k to $250k net worth.

Knowing all of this, having “lost” $50k doesn’t mean anything in the short term.

I’ve got loads of money still and still going to Europe for a month, the hell do I care? In the long term, it’s only going to change things if the stock market acts antithetically to its behavior over the last 100 years. And by “change things,” I mean “putting off my GoldFI milestone for a few more years”. Again, the hell do I care? That’s still a huge accomplishment in the era of stagnant wages and high inequality; even more impressively, it would STILL leave me a millionaire decades before traditional retirement age! I will be sure to bask in the ambience of medieval castles and Scandinavian fjords knowing I’m more set than millions of people. Life is good. I’m doing just fine.

With A Few Caveats…

Caveats being: I do not panic sell, I do not try to pick stocks individually, and I do not overspend. But hey, that’s old news on this site. All good. 🙂

Cover image credit: Rainier Ridao via Unsplash

You are indeed still good Darcy. Me too, even if I am off my peak net worth by well over half a million. In my case I’m fine if the stock market never goes up again, but that’s because of the unfortunate reality that I am not going to live past another 30 years most likely. And while it could hang in the doldrums for as many as ten years that’s very unlikely and even if that happened it would be off to the races after that. You’ve got a winning plan and attitude. Very rare stuff!

Thanks friend! Mortality isn’t a topic many folks like to talk about, but it should be kept in mind when you’re planning out your goals and dreams.

Trust me, when half of the people in the obits section of the digital newspaper are younger than you, mortality becomes very real! But that’s so far off in your future it’s not something to worry about now. Still, life is just right now, for older me and younger you just the same. So live today like it’s your last is good advice. So I’m going to go play tennis!

Don’t you mean: “you should only be investing money that you will NOT need to make rent or groceries next month.”? (the “not” is missing.)

Also, congrats on your savings and have fun in Europe!!

Oh crap, thanks for pointing out that error! And thanks for the well wishes, friend 🙂