My 2017, 2018, and 2019 Spending or: How I Learned to Love the Tax

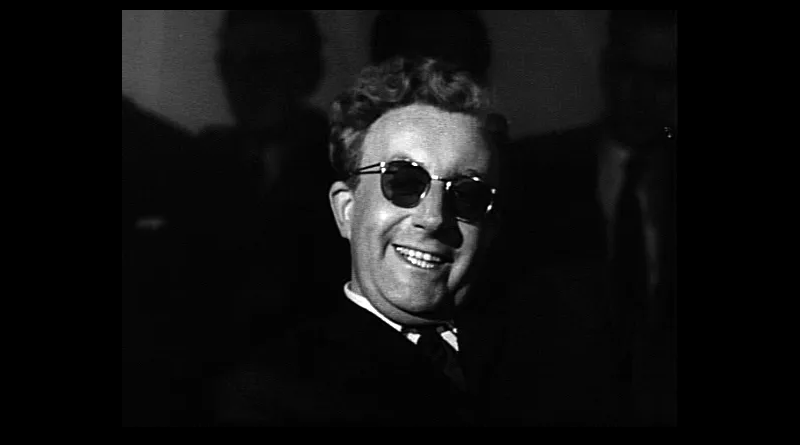

Man, what a loaded title. You’d think I’d have a better one, since I’ve made marketing my whole career. Yet my love for pop culture references has no end in sight, so let’s move on to what you came here for: the saucy We Want Guac spending metrics of the last three years!

I included two additional years to that so you can have an idea of my expenses every calendar year after graduating college in 2016. I also didn’t start tracking my expenses until late 2016, so I only have data for the last three years post-college. Even then, the data has only mellowed out in 2019; this is the only year that I feel my expenses are going to stay flat, unless I spend on something huge like LASIK surgery or my brother’s college expenses.

The Life of Darcy: My Life’s Expenses

Total spending in 2017: $13,280

Spending was so low in 2017 because I was experimenting with how low I could get it. This was after what I call my Year of Fear in 2016, when I was terrified I’d never dig myself out of my student loans and seriously considered living in some abandoned woodland cabin. Instead I rented a room without heat or AC for $600 a month with one super awkward roommate, who liked to wander around our tiny space and curse to himself (he was always nice to me otherwise!)

I kept living there until mid-2018, when I finally felt I could afford Boston’s rental prices on my own. Now, I wouldn’t recommend the extreme I undertook as I was still weaning myself off years of nervousness. I took exactly one out-of-town trip that year and it was to go back to my hometown Fearsville for the holidays. Besides that airplane ticket, my biggest purchase of 2017 was a three-in-one heater, dehumidifier, and AC unit off of Amazon. That attic space I shared with my roommate shared electric with the rest of the house, meaning we didn’t have to pay that utility and I could use that unit as much as I liked!

Total spending in 2018: $24,985

2018 expenses jumped so high because that’s when I moved midyear to my current apartment, 2.8x’ing my rental expenses. That also included first month’s, last month’s, and a security deposit. This figure is also a MUCH more accurate reflection of what people actually spend, despite this figure STILL being much lower than what people spend ‘round these parts. This is also the year I got my second post-college job, which paid me a $60k salary! It was MUCH more comfortable to live off of that salary than my previous one, and I knew already I could spend at a low level if things got dire. So off I happily moved, and I haven’t looked back since. Last I heard my old roommate is still doing well, and now with a friend of his in the apartment relieved with the low price.

Total spending in 2019: $29,999.29

Yeah, that came hella close.

In 2019 my expenses mellowed out to 30k, which was my goal starting out in the New Year. Since then I got a raise at my job, then moved to another company and got a much bigger raise (making my salary + bonus pay go from 60k to 90k). I’ll walk you through my salary history in another couple days.

This salary, of course, is pre-tax. If you’re looking solely at my earnings (instead of my take-home) I’ve saved 50% of a 60k income and 66% of a 90k income. Yay! Taxes and pre-tax deductions obviously bite into that, but your total salary or wages is a good starting point as a metric for how much you can comfortably spend. If we’re looking at the last three years’ spending in percentages commensurate to my salary, here are those numbers:

2017 – 32% (aka saving 68%)

2018 – 42% (aka saving 58%)

2019 – 40% (we’ll say)(while saving 60%)

Notice that I said this is a good starting point for identifying how much you’re spending. After identifying how much of your salary you’re spending, you’re gonna want to know if it’s okay to spend that amount. The rule of thumb for this (or the only one I could find, anyway) was the 50/30/20 rule. This states you should spend half your salary on needs-based expenses, a third on splurges and other wants-based things, and a fifth on saving or paying back debt*.

Again, good starting point if you’re really an utter novice at all of this. However, spending 80% of your paycheck will not do you any favors. This rule will also fail you if you forget to differentiate between pre-tax and post-tax income. If you’re spending 80% of your pre-tax paycheck you’re definitely living above your means. Either way, you’re missing a crucial piece to the puzzle of getting to financial stability, which is the means to do so.

Spending Rules Now = Six-Figures Later

Instead of that 50/30/20 rule, I threw that out and instituted ~*~Darcy’s Spending Rule~*~. The DSR is this: Your post-tax salary should aim to have a minimum of 30% saved. This is more than a quarter of your salary, and obviously untenable at first to folks who are drowning in debt or one paycheck away from catastrophe. Before you fire up your keyboard, note that I said AIM TO. “Aiming” brings to mind archery: you want to hit the bull’s eye, but first you need to learn how to hit the target at all.

I chose 30% based on how much someone on a $50,000 salary could reach six figures by saving alone. If tax takes out 25%** you’re left with $37,500. Thirty percent of that shakes out to $11,250. Now, if this 50k-a-year person never gets a raise (even beyond a cost-of-living increase) and, for whatever reason, chooses NOT to invest that money, they will still reach six figures of wealth in today’s dollars in a little less than nine years. If they choose to invest it and get average market returns – which is roughly 10% – this milestone comes even sooner at LESS THAN SEVEN YEARS.

Yo, just think about that for a minute. You’re not even raking in the big bucks yet and, if you’re fresh out of college, you could be worth six figures BEFORE you hit your 30s with room to spare.

This, again, is assuming a lot, including that you’re able to save at least 30% of your income in the first place. Another massive caveat to this is one that hasn’t been available for most of human history: you’ll continue to have access to work in a stable country where you can pursue such endeavors freely***. To that end you need stuff like education (to learn to do the work) working roads (so you can actually get to work) and support for those who can’t work (so you have more access to better work opportunity).

Stay on the Tax Run!

Now, other financial gurus like Dave Ramsay state that taxes are generally a family’s biggest expense. I disagree with that on two fronts.

One, if they found ways to best optimize their tax burden they’re likely paying more for something else, like their rent or mortgage costs. Even with my $90k salary my rent STILL beats my tax burden by a few hundred dollars.

Two, a family’s tax “burden” should be providing way more in value. If this same family is spending a noticeable amount on things that don’t provide value, like designer handbags that require maintenance (yikes) or trinkets from late-night commercials and drunk Amazon purchases (double yikes) then the money that goes towards those things will never serve them. The money you pay in taxes, on the other hand, should pay you over and over again.

Those taxes pay for your kids to attend school, and they pay for your neighbors to get through hard times. They pay for your safety against anyone that might wish to do you harm, and they also pay for keeping the systems that let you pursue financial stability in the first place. If you feel they’re NOT doing these things, guess what! You have a say in who gets elected to make these decisions. You’re not living under a dictatorship or a monarchy with limited options.

While this is still far from perfect and plagued by massive systemic problems, the system we have in place is, historically, remarkably stable. It enables a life of wealth to your average Joe that, even in the twenty-first century, is still unheard of in some parts of the world. So, yes, I’m more than happy to pay my taxes. I will never be one of those that cries about them or corrupts the system instead of paying my fair share. I value the services it provides too much to do that.

This has gotten much longer than my other posts so far so I’ll wrap it up here. In conclusion: don’t be upset with your taxes because they should be paying for services done so you and your community will benefit. Also, track how much you’re saving and spending after you pay taxes. It’s good for the soul, great for planning your future, and necessary for building your wealth.

Do you know how much of your paycheck you pay in taxes? How does that correlate to your overall spending?

*Did I lose anyone by speaking in fractions instead of percentages? Don’t worry – I get lost sometimes too! But I’d highly recommend getting used to switching between percentages and fractions to make your financial math easier to understand. You’ll get there.

** We play math FAST and LOOSE here. I’m purposely conservative with projections so I’ll be either okay in the future or pleasantly surprised. There’s plenty of other blogs out there that do nothing but dig into the nitty gritty; this blog is not one of them.

***Yes, I’m well aware of the current political climate. Yes, I know there are government officials having a meltdown. No, I do not need political commentary on why I’m wrong on this and global warfare with extraterrestrials and lightsabers is imminent.

Pingback:Understanding Investment Accounts: 401(k), IRA, HSA, and Taxable - We Want Guac

It’s always a breath of fresh air when I see a FI bloggers remind people that taxes pay for things we all benefit from and maybe (just maybe!) we shouldn’t do everything in our power to minimize what we pay into the society that has allowed us to build so much wealth.

I’m assuming when you say someone should save 30% of their post-tax income, you’re adding pre-tax deductions back in. That’s how I calculate my savings rate, anyway, since it is being saved!

Ugh, exactly. I think people more have a problem with how their taxes are allocated than the actual taking of them; I have yet to meet someone from a Scandinavian country, for example, that doesn’t support their tax rates, simply because they get so much more value out of them.

And yep, I’m adding in pre-tax deductions into that calculation! Good eye 🙂

Thank you for talking about the value we all get out of the taxes we pay! Pursuing FI in my twenties while also being extremely politically engaged (as a progressive) can sometimes feel like an odd fit. It’s nice to see people in this community who aren’t completely focused on minimizing their tax burden as if tax are the worst thing that ever happened to them.

You’re telling me – on the outset financial independence makes it seem like there is zero room for anything related to the Big Greedy Government. It’s hard to discuss politics as it relates to personal finance as well, unless you’re discussing tax avoidance strategies. At the end of the day it’s about making sure your tax dollars are being properly allocated, especially on a local level. For example, my city spends over half the budget on education, which I love to see the focus on. Government is ideally about giving a net benefit to civilization, after all, and taxes are how they get it done.

Pingback:My Money in 2021: The Biggest Everything Ever - We Want Guac