United States Income Tax Brackets, Explained

Throughout my social media and news sources, I’m seeing a ton of confusion around how tax brackets work. If you’re already struggling to afford the lifestyle you want, of course you don’t want more money siphoned from your paychecks. Thing is, you’ve never really had tax brackets explained in a meaningful way; these tax hikes should be (and are) geared towards those making way, way more money than you are.

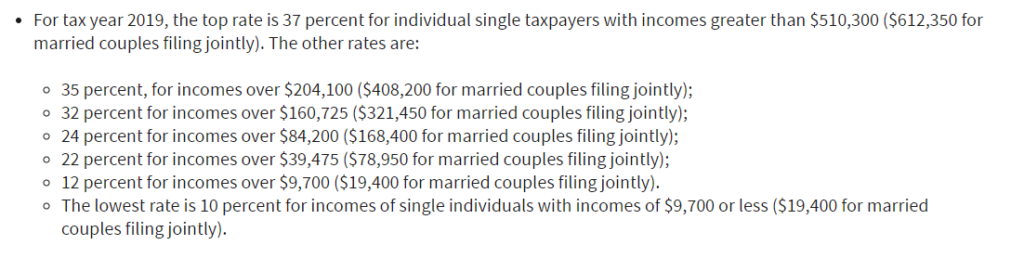

But understanding tax brackets is easier said than done. There’s a lot of misunderstanding around how tax brackets work and how much money someone really has to give to Uncle Sam. Here’s how the good ol’ IRS explained the tax brackets for 2019, pulled directly from their website here:

Yeah, they are not well-known for ease of understanding.

That tax rate, at first glance, looks like the percentage of your salary that you pay in taxes. If you don’t know any better, you’re going to immediately believe someone making $78,949 a year is taking home more than someone making just a few thousand more.

GUESS WHAT: these tax brackets are on percentages of your income, NOT THE WHOLE THING. (Not that this really tells you for sure.)

The Basics of Tax Brackets Better Explained

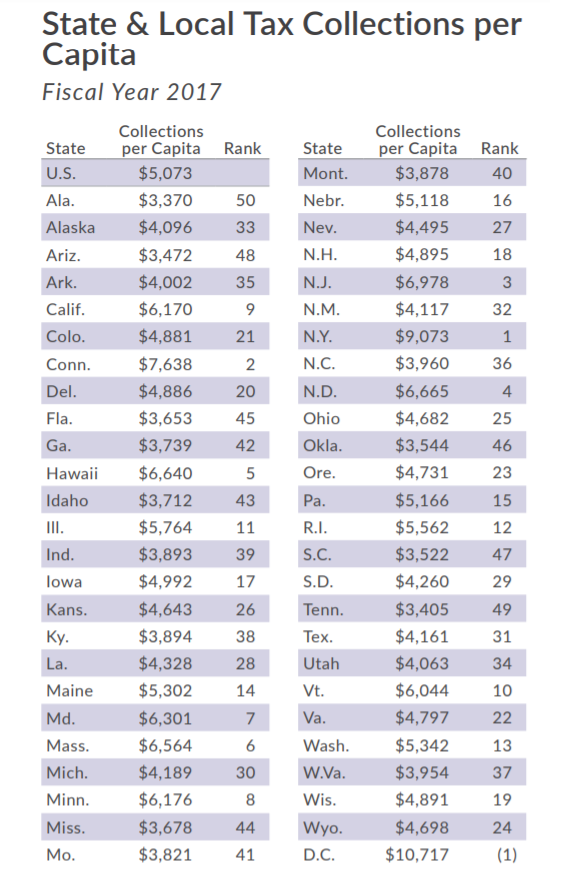

First things first: you will need to pay both federal taxes AND state taxes. That means every American will pay the same federal taxes, but not total taxes. The total amount you pay in tax depends on where in the Union you happen to live. For example, I pay more in tax as a Massachusetts resident than I would as a New Hampshire resident. Illinois residents pay more than those in Arizona. You get the picture. We’ll get to the nuance in a second after looking at how much you have to give to the federal level first.

(Note: The following calculations are done using the tax brackets from 2019; the IRS readjusts them every year to keep up with inflation. The only reason I use them is because I started writing this post back in January and wanted to use what was already written.)

We’ll use some easy math here to kick things off. Let’s say Example Ellie (who is filing as single) makes $100k a year. These are her tax rates, broken down:

- $9,700 is taxed at 10%. Of this she will pay $970.

- $29,775 is taxed at 12%. Of this she will pay an additional $3,573.

- $44,725 is taxed at 22%. She will pay an additional $9,839.50.

- Finally, $15,800 is taxed at 24%. For this part of her salary she will pay an additional $3,792.

This makes her federal tax burden at roughly 18% total (or 18.1817% for the anal-retentive folks). It’s nothing but a MYTH that, if you’re on the cusp of the next tax bracket, it’s better if you don’t get a raise because more would be taken out.

THIS IS SO FALSE!!!! I’ve even had college professors believing this (which we’ll discuss in a sec)! SO UNTRUE!!

Look, people complain taxes are complicated because guess what? They’re not straightforward! This doesn’t mean you can’t wrap your head around them, even if they make it hard to really understand how taxes work.

That’s a different story.

At first glance at the IRS guidelines someone would assume Ellie is paying a flat 24% on her entire salary, which is definitely not the case. She’s taking home several thousand dollars more than that. That difference is enough for 8 plane tickets to Europe, almost 2,000 orders of chips and guac at Chipotle, OR your very own hobbit home! (Not joking about that last bit, FYI.)

So: the tax RATE is the overall percentage Ellie pays in federal taxes. In her case this is a smidge over 18%. The tax BRACKET is the highest tax rate her income reaches. In this case, 24%. For more understanding, Vox has an excellent visual breakdown of how this all works:

Tax Bracket Case Study

Just for shits and giggles let’s also break down the tax rates for “Dr. Pickle,” my former quirky college professor. If anyone needs tax brackets explained to them, it’s him. He has an $84,199 salary in this hypothetical. Because he doesn’t understand finance, the department offers to increase his salary and he thinks it’s a bad deal. Let’s say they know he’s an idiot and offer to up it to $84,699. Why not lowball him!

I know for a fact Dr. Pickle is filing single because he’d complain all the time about his dating life. Knowing that, it’s easy to figure out his taxes from there.

- 9.7k at 10% = $970

- $29,775 at 12% = $3,573.

- 44,724 at 22% = $9,839.28

Meaning his old salary will net him $68,458.48 after federal taxes.

Here’s the numbers for getting that $500 raise:

- 9.7k at 10% = $970

- 29,775 at 12% = $3,573

- 44,725 at 22% = $9,839.28 (roughly)

- 500 at 24% = $120

Would you look at that. Dr. Pickle got bumped only a little bit into the next tax bracket up, yet he’s coming out ahead. Even if he only got a $2 raise to bump him up into the next bracket (which, by the way, is basically an insult) Dr. Pickle is STILL making more money than he would have otherwise. Which is all to say:

In no way will you LOSE money by entering a higher tax bracket.

Let’s not quibble over nickels and dimes. There’s more money on the table than that.

If you’re getting pissed off because you pay more in tax than these numbers suggest, pat yourself on the back! You’ve just recognized that you’re also paying state taxes on top of this!

State Income Tax Brackets, Explained

As I mentioned earlier, breaking down how much money your state will tax you for is a whole ‘nother beast. Some states use the tax bracket system on your income, but that’s not the same across the board; Ohio’s got about five tax brackets you need to worry about, while Hawaii has twelve so it can be special. Some states don’t even have tax brackets; my state, Massachusetts, just charges everyone the same income tax rate of 5.05%. Things only get more complicated with factors like your filing status (single vs. married) and standard deductions.

However, researchers make it easy enough to tell on a basic level which states have a lighter tax burden than others. The Tax Foundation has a great rundown of which states collect the most money from its citizens, along with a lot of other nifty summaries throughout their site.

Forty one states have some kind of income tax; two states (New Hampshire and Tennessee) only tax your income if it’s from a dividend or interest. And seven states – Alaska, Wyoming, Florida, South Dakota, Washington, Nevada, and (of course) Texas – levy ZERO income taxes whatsoever. The important thing is that you should feel you’re getting your money’s worth for both yourself AND your community.

It’s when you’re not getting that value back when you know there’s a deep issue with how your state allocates its tax revenue. It’s very worth it to check out what your state is spending money on, which you can get started on by searching “[you state] tax spending”. Check out what your more local elected officials are spending money on to boot. It’s a democracy; check to see it’s all reflecting the right things.

Darcy’s State Tax Opinions

Thanks to the amount of deductions I take out between my 401(k) and HSA, my total tax rate hovers around 21%. If I didn’t contribute to these accounts, my tax rate would be more like 30%. Yep, almost a third of my paycheck would be going to the government. Between my state’s income tax and Social Security/Medicare I’m actually paying more than what the federal taxes require.

I’ve written before that I’m not actually mad about it. Like, at all. But I understand why some folks are. Misallocating funds and acts of corruption are a major worldwide issue, especially in communities where its spending isn’t all that transparent. This is why it’s extremely important to educate yourself on where your taxes are going. Guarantee you won’t mind so much at the money you pay in taxes if you see what it’s going towards.

If you want more explained on income tax brackets I’d reach out to a tax specialist for the nitty-gritty. If you’re like most Americans and make less than six figures, this is the info most relevant to you. Stay informed out there; it’s way too easy to maintain ignorance.

This topic is right up my alley. I am an accountant and people in my professional love doing our own taxes. This was a very thorough and accurate post, and I also really like your tax tip at the end by taking full advantage of your employer’s 401k benefits, and HSA or FSA to reduce your net taxable income, and possibly staying in a lower tax bracket.

I am SO GLAD to hear that, I feel like I just got the accounting stamp of approval! Understanding this would go a long way for more folks, especially those outside of your profession 😉