Your Ideal Salary or: The Number You Should Really Aim For

More often than not I’ll get messages from others who want a high pay job. They want to go beyond my three-step series on the topic and get specific, tailored advice on what they specifically should do. And time and time again, I need to ask them for more information, like “what’s your ideal salary? What’s the minimum salary amount you’d be fine with?”

What I’ve realized is these questions can be very hard to answer. The “ideal salary” might feel beyond what is actually doable with your current skill set or career trajectory. Who knows what the minimum salary amount would be if you don’t have a grip on your spending. And not to go Austin Powers on you, but wouldn’t the “ideal salary” be ONNNEEEE MEEELLLLEYUN DOLLARRRRSS?

I mean, sure, my ideal salary would be seven figures too, if I could swing it. Maybe one day I’ll get there, but for now I’m pretty happy with my criteria for finding a lower ideal.

Know Thyself

How much do you roughly spend in a given year? I couldn’t have answered this question pre-2016 because I never had a budget or tracked my spending; I was too scared of money to want to put in that work. This meant that, post-graduation, I had to painstakingly plod my way through setting up a budget and tweaking it as needed. Now it runs as smooth as Tennessee whiskey down Morgan Freeman’s throat, and any increase in spending happens only after I decide in advance. We’re not big on uncontrolled lifestyle creep, after all.

This is also important for determining the baseline salary you need to maintain your lifestyle. If you’re spending $33,000 a year like moi, you need to earn at least $33,000 post-tax (or around $42k pre-tax if you’re taking tax brackets into play). Spending $50,000 a year means needing $50,000 post-tax. Same goes for spending $20,000 or $80,000 or ONE MIIIIIILIYIN BUCKS. Unless you choose to cut your spending for more wiggle room, that’s going to be your bare-minimum baseline.

Now for the ideal: you’ll want a salary that not only covers your spending, but lets you save and invest a significant amount. When you’re in your 20s, having disposable income invested transforms your life to the next level. Reach six-figure wealth before you hit 30 and you’re as close to guaranteed as anything can be of becoming a millionaire as an adult. If you don’t touch that money until you’re 65, you’ll be a multimillionaire to boot. Pay attention to what you spend money on to garner your minimum and ideal salary.

Know Thy Goals and Dreams

I’m a little obsessed with pointing out how tightly your financial health intertwines with your goals and dreams. Dream of being a homeowner one day? Better pony up enough for a down payment and get ready for that three-decade mortgage. Dream of worldwide travel? Not as expensive as you might think, but still runs you a solid amount. Dream of more time with your family and loved ones? Betcha work takes up all your time at the moment, and it wouldn’t have to if you didn’t need the money. Thanks, capitalism!

This isn’t to say you won’t ever accomplish your goals and dreams if you’re broke. This is to show you how much closer having enough money will bring you to your goals and dreams. The more money you save and invest – which brings in even more money when done right – the closer your goals and dreams are to becoming your reality.

This ties in to determining your ideal salary by deciding how much money you want to have left over every year. If you’re not saving or investing anything right now, you’re making zero progress on the goals-and-dreams financial front. To change that, you’ll need to up your salary enough to reach a savings level you’re satisfied with. What does that look like for you?

For a little guidance, here’s some (very) rough numbers of how much money I’ve managed to save over the last few years:

Darcy’s Savings

| Year | Amount Saved |

| 2016 | $8k (my best estimate) |

| 2017 | $22k |

| 2018 | $28k |

| 2019 | $33k |

| 2020 | $40k |

Notice how that number keeps going up? That shows you don’t need to start being a savings superstar right out the gate. You just need to decide how much money you’d feel good about saving.

Or do what I did and make that an ever-evolving number. I plan to ride this gravy train for as long as humanly possible. Full speed ahead! 🚂

Do Ya Research

If you’re happy with the career field you’re in now (like marketing, government work, or office administration) play around on sites like Glassdoor to see what different job titles pay in your area. If you want to make a change to another career, go back to Glassdoor to look up the job titles that interest you and/or have transferrable skills. For example, the skillset needed to become a marketer overlap with the skills needed for careers in sales, advertising, and public relations.

Want to go live somewhere else? Check up on what job titles pay in the cities you’re considering. I do this sometimes just to get a baseline comparison and recently found out marketing titles like mine get paid MORE in CHEAPER cities like Minneapolis. It gave me serious pause as I imagined moving to the Twin Cities to live it up on less. And to become a homeowner that much faster.

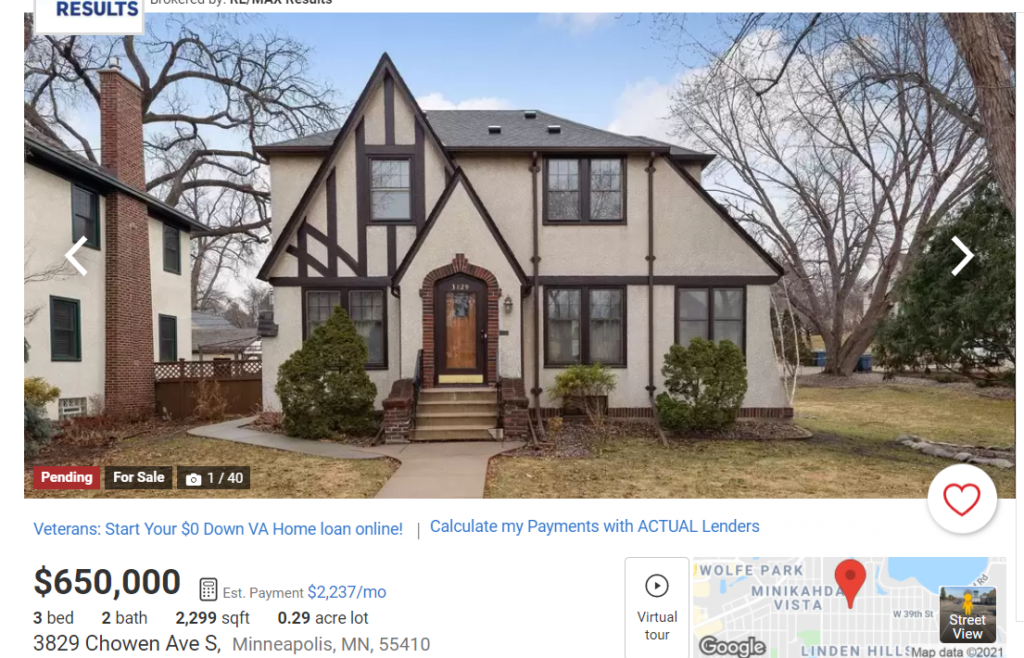

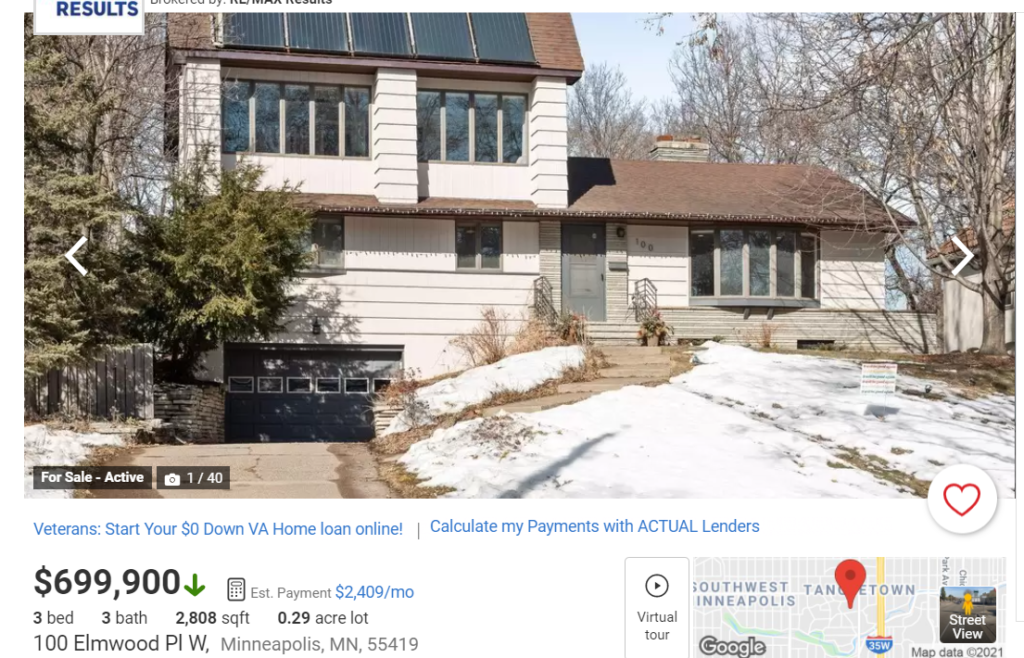

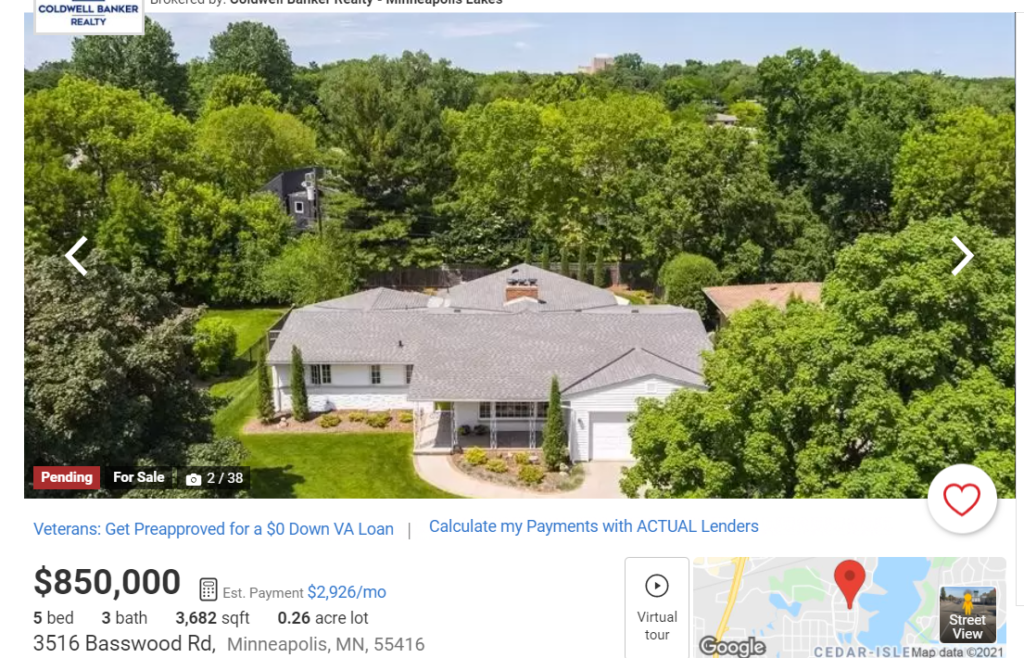

I could buy ANY of these homes RIGHT NOW if I wanted to! These would cost double the amount if they were in Boston instead. I spent way too long drooling over housing that’s so much more affordable ;_;

ANYWAY, doing the research shows you what’s possible out there. It gives you a clear picture of what different jobs pay so you can align your search to the higher-paying ones.

Be Optimistic, But Realistic

If you want to make a million dollars in one year, you’re going to have to do something absolutely extraordinary in the world of business. It’s not impossible, but it’s extremely difficult to work your way towards, especially if you don’t just luck into it. That’s on the extreme end of the scale; something like an above-average salary (average being about $52,000) is a lot more doable. You’ll have to tailor your resume to these above-average roles, of course, and show through your experience and interviews that you’re the right person to hire for the role.

Easier said than done, in this day and age. Particularly when nepotism is a nasty force to be reckoned with.

We don’t live in a meritocracy; there are plenty of people who are smarter than me and more hard working who earn a third of what I do. There are also people who are dumber and lazier than I am who enjoy bloated 7-8 figure wealth. The system is rigged to favor people of a particular race, gender, ethnicity, nationality, sexuality, family class, and belief system. I don’t tell you this to discourage you; we continue to make progress in breaking down these barriers, to the point where a queer girl like me can make it rain and no one so much as bats an eye.

I bring this up because you, too, will have to deal with the inherently unfair system the world has in place. You’ll have to deal with it, work your way around it, and – if you reach a point where you have enough influence and mental resources for it – help remake it into something equitable and meritocratic.

What do you consider the ideal salary, given all the above? Your minimum salary?

Cover image credit: Deva Darshan via Unsplash

You’re right, this is a very difficult question to answer. I figure my ideal salary would be enough to live comfortably in the geographic area I would enjoy the most. Unfortunately, that area is in southern California and very expensive. The median income in that zip code is around $150,000 per year. If I were to be able to make $150k and live in that area, I would do it in a heartbeat. Would I consider moving there if I made less? Yes, since living there would provide a significant happiness boost, I’d still go there with a minimum $100k salary.

WHEW, I knew SoCal salaries were bloated but not to that extreme. $150 is the MEDIAN salary? No wonder people are going nuts about moving there…

I consider zero to be the right number. In fact one year after I retired from full time work I turned down a million dollar offer to go back to a 9 to 5 and chose to stay mostly retired. Zero dollars and most all my time seemed like a much better deal. My wife did get a funny look in her eyes when I told her about it, but she got over it, I think…

Hey, you’ve got the money to never NEED a salary so technically zero would be the magic number. Nice!

My ideal salary is ONNNEEEE MEEELLLLEYUN DOLLARRRRSSs.

YOU KNOW IT

YES PLZ

I’m currently (not by choice) a sole provider and so my ideal would be around $150k or more.