After Being Poor, Your Financial Anxiety Remains

This is not a brag post; this is me trying to grapple with new wealth and financial anxiety when I have no family or friends to discuss this with. It’s also me still dealing with the same anxious mindset I had when I was an underemployed college graduate, one who was very aware there was no familial (or much governmental) safety net if I happened to fall.

In early February I wrote about hitting the $200,000 milestone in personal wealth. In the 1.5 months since then my net worth went up another $20,000. The bulk of this is thanks to a sizeable bonus, tax returns, and short-term investment growth in my index funds. There was a point in my life that I measured reaching my first $20k over years; now the same growth can be measured as a matter of weeks? Days? That’s so fast already and I hear it’s going to get even faster as time goes on. At this rate I’m definitely going to hit a $250k net worth later this year, assuming overall market returns are at least 0%.

Which is to say: I’m good. I understand that.

Does that mean I actually feel good? No.

Because now I’m going through the steps of making my first major purchase post-college in buying a car. The final paperwork should go through next week and make me an official vehicle owner, which is what I have told myself I’d do in 2021. And the thought of spending the thousands of dollars to get it is, unexpectedly, dredging up my old mindset of money anxiety and hardship.

My lizard brain is screaming “DON’T DO IT!” and my body is physically tensing up when I think about writing that check. Logically, I don’t understand why I have this financial anxiety. You guys know how much money I make and have; it’s more than what most 26-year-olds have in this country, let alone the world. It’s not like this car purchase is going to put me into debt, either. I’m buying a nice used car with all cash so no car payment, ever. The sales price is also less than four percent of my overall net worth; if you had $1,000 to your name, it’s the equivalent of the SUV being $35. Car insurance, maintenance, and all the other little expenses a car needs are easily covered by my cash reserves and paychecks. And even after all of this I’ll have close to five figures sitting in cash.

So this?

It makes me feel so uncomfortable when I know it shouldn’t.

Having a car would be awesome. I could go on road trips whenever I wanted to. I could easily visit friends in Vermont and Maine without dealing with rentals. Oh my god, I could pick up my own furniture with a big enough car. The national highway system could be mine for the taking! All I need to do is get past my fear of spending so much! And it’s harder than it realistically should be!! Why is doing this nice, affordable thing for myself bringing my fight-or-flight response to the forefront?

Financial Anxiety from a Lifetime in the Poverty Mindset

I want to reach out to this lady and interview her about this tweet – she summarized my feelings perfectly in less than 100 characters. She also made me think about how my current financial anxiety might have it roots in the 1990s instead of my 2016 Year of Fear. See, I’m not sure if my family was ever poor growing up, but my parents’ money habits/poverty mindsets made it feel like we were. I never felt like I could ask for nice clothes; whenever my mom would bring us kids to Kohl’s my younger sister and I would stick obsessively to the 80% racks, combing through them for something we wanted badly enough to nervously request.

The same nervousness around money spent permeated everything; at one point in high school my mom full-on screamed at me because I used a lot of (regular, Grade A, white) eggs while making dinner. Apparently eggs were expensive in 2011? Not something I would’ve known.

Stress and poverty go together like flies and manure. And it’s no secret both play some very concerning games with your brain. “There’s a PTSD that comes from being poor,” indeed.

It’s hard to think about how much this still affects me years later. Logically, I’m very obviously ahead of the financial curve. But logic alone doesn’t conquer the deeply ingrained money psyche I’ve developed throughout my first two decades of life.

Even today I still struggle with just buying things I want for myself. I’ve repressed the desire for things for so long and so thoroughly that now it’s a struggle to even identify the things I want. I need to consult a list on my Notes app titled “Things to Buy” because my mind goes blank if I try to remember what I wanted to get while in the store. I’ve programmed myself to go without going back into my childhood. Debugging that now is not a simple task.

Because I Still Have Financial Anxiety After Being Poor, That’s Why

Since my college graduation in 2016, the most money I’ve ever spent was in a first month, last month, and security deposit put down for my current apartment ($5,100). I remember freaking out about that decision too, despite it being an amazing decision for my quality of life. (Not to mention how phenomenal it’s been in a yearlong pandemic.) The logical lady in me has crunched the numbers and measured this car’s compatibility against my goals and dreams. I WANT a car. The one I’m getting is a good deal. It’s in my budget and I have more than enough cash to pay for it. Yet all of these calm, logical points don’t make much different in the panic-stricken lizard brain still stuck in impoverished times. Anxiety isn’t that big on critical thinking.

And financial anxiety is no exception.

It’s so tiring to know I have to deal with these money worries when they’re no longer serving me. Sure, those thoughts and physical responses stopped me from following the standard fallacies in mismanagement when I had very little to my name. That is now a far cry from my reality and I want off this train. If I want to get rid of this ridiculousness for good I’d need to do some inner work to finally banish it. You’d think the numbers I have in my investment accounts would be enough, right?

I really wish it was; doing this internal processing and analysis on this is unearthing a lot of negative feelings I didn’t know I still held onto. Feelings of shame, of trauma, of fear. It’s not something that gives me the warm and fuzzies to dwell on, to put it simply.

If someone doesn’t have that money growing up, it’s like being shot through with too much energy […] There’s this undercurrent that money equals love, power, security, control, self-worth, self-love, freedom, self-esteem — all those loaded things that money supposedly can do, but doesn’t.

Therapist Olivia Mellan in the New York Times

So despite possessing a net worth that continues to boggle the mind, it takes me time to process plunking down this much money on, well, anything. Once I buy a house I’ll likely need someone with a defibrillator on standby, just in case. Spending money at all used to be outside my comfort zone, and it was thanks to budgeting giving me “permission” to spend that I actually did start buying healthier groceries and whatnot.

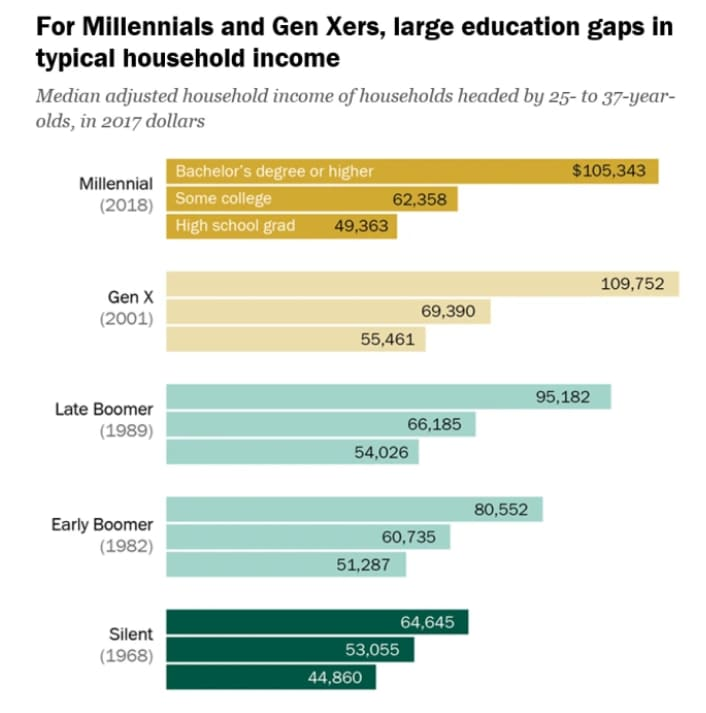

The Rise to Wealth on a National Scale Shows I’m Not Alone in This

I even see this cycle on a national scale and find it sad. How many Boomers were lifted out of poverty thanks to parental sacrifice or their own career prospects, only to turn around and sneer at the succeeding generations for struggling? For that matter, how many multi-millionaires have a rags-to-riches story and STILL can’t fathom why they should try to aid those impoverished? I think their relationships with money, like mine, are warped. They’re terrified someone’s going to come along and take it all away from them, so they take their fears out on the less well-off and hoard instead of help.

I’m relieved to note my money issues won’t propel me to that level of impotency – in the next three years, for example, I’m going to set up a scholarship at my hometown community college, which I am so excited about I almost can’t wait to do. The main thing standing between me and that hot mess is my financial literacy, which is, unfortunately, a rare skill in this country. Leaving my money issues to fester would practically give my financial anxiety carte blanche to run my life. Going down that road would lead to me living in a shack eating grass for sustenance despite being wildly rich.

When you’re in the circumstances to need to do this, you’re IN IT. Once you get out of those circumstances, the residuals stay with you.

Seeing Financial Anxiety Play Out Throughout the Present Day

At the core of it I keep expecting something to come up and wipe my wealth away. You hear of it happening, sometimes. Sometimes hearing those stories changes my behavior for the worse, too, in very stupid and embarrassing ways. Here’s a more humiliating anecdote, for perspective: a few years ago I got hit by a van (yes, HIT BY A VAN) and didn’t go to a doctor to check if I was okay. A friend of mine had to convince me to go get looked at, rightfully telling me how senseless that was.

And despite her making sure I knew the dangers, to this day I’m still reluctant to see a doctor if I notice something funky going on. My weird poverty mindset rushes in and bellows hey, I have the money for now, but maybe that’ll change if I go in and they discover cancer or some other expensive disorder. Then where would I be?

Like, okay Darcy, you’d be healthy? You’d get treatment and be okay? Or the doctor might not find anything and simply charge you $40 for the appointment. Which will still make you feel bad because that’s $40 you could’ve saved. Which means you’re back to the start of the cycle and need to go through the justifications all over again, ad nauseum. Just because you get a high-paying job doesn’t mean your relationship with money is automatically stellar.

Understanding how to manage your money makes life 100% better. There is no way I would have reached $220,000 otherwise; it’s wholeheartedly worth it. What I didn’t understand was how much my time on the edge of poverty would shape me and continue to influence my moods and decisions.

I seriously cannot wait to be able to drive all around New England. I can go visit friends flung all over Maine and Vermont! Hiking whenever I want! So much less hassle visiting far-flung places!! All I have to do between now and then is deal with my financial anxiety. Which is a surprisingly tough task, no matter your net worth.

Cover image credit: Fabian Møller via Unsplash

Hey Darcy! I loved this post (as always). I was lucky enough to grow up in a stable household yet some of these things resonate with me as well. We were an uber frugal house. I still never buy food at sporting events, museums, or any other location without free and open competition to food selling. (I should be thankful enough to attend the event. Heaven forbid I buy overpriced food.) I hem and haw about purchases and frequently talk myself out of things I’d need and enjoy.

Self awareness is the first step towards changing unhealthy behaviors. You’re rocking things on the self-awareness front. And hopefully this leads to a more healthy relationship with money. And if you ever drive back to the Midwest in your automobile- you should totally swing by for a visit.

I TOTALLY will visit the Midwest! I’m hoping buying this car will prove to myself bigger purchases are fine to do when I’ve planned for them and know they’ll make me happier. I’m the same way with not buying overpriced food – I was just at Starbucks today and talked myself out of getting the expensive yogurt, despite having a gift card (why I was there in the first place!) which would made the cost to me about $0. Sigh… baby steps!

My mom got sick when I was 13 and couldn’t eat anything but yogurt and fruits for 3-5 months. So I started making her natural yogurt at home by buying the milk from a store and Mixing a spoon in it to mix and make it ferment in a ceiling space.

She was so impressed she gave me the money for it all.

I used it on paying a mechanic to fix up random things on her car that bothered her for years.

What happened to the guy that hit you with their van? Did you get to file an insurance claim vs him? Was it a hit and run? One of my fears is to get involved in a hit and run accident. I got hit and ran over twice in the past four years, lucky that there were no injuries, but it’s still a harsh reality to grip around.

I feel the same way with financial anxiety. I had a scarcity mindset when going through the net worth climb and even if I wanted something, I refused to buy it. Even after I bought it, I felt guilty! There’s less of it now but I still feel uneasy and guilty whenever I buy something that I didn’t budget for. Maybe one day it’ll go away?? Who knows.

The accident was my fault – I was racing down the sidewalk on a one-way street and the van driver was coming out of a parking lot and didn’t see me. Luckily I ended up being fine (always wear a helmet!) just shaken up and a little sore. You know how terrifying it can be from the sound of it.

I guess we’ll both see if our financial anxieties will go away with time! Maybe it’s an exposure thing and the next big purchase won’t feel so guilt-inducing, fingers crossed.

This is so real.

The change in mindset from poverty to abundance was HARD, and it took me at least a decade to mostly shift out of the hoarding mentality to accepting we are financially in a good place. There’s all kinds of talk about how to change your circumstances by earning more / negotiating / saving / investing etc etc etc. But it’s uncommon to hear people talk about how to healthfully navigate the mental path between “I’m poor, act accordingly” to “I’m not poor (what does that MEAN)”.

I STILL have anxiety over it all going away one day, or my health suddenly crashing (as my medical history is pretty bad) and leaving me unable to work and wiping out our savings. I am still jittery about choosing to spend any money on myself. I’m fine spending on my family within reason but myself? Mental blocks! Everywhere! It’s slowly getting better but it’s a real journey of consciousness.

I hope your self awareness helps you navigate your version of that journey with fewer bumps and panics.

That’s it! Who knew there had to be a mental reckoning between having a little and having a LOT. I think I assumed people fell naturally into a richer mindset once their wealth reached a high level; it seems that way because money stressors are supposed to be “gone,” but we all know brains don’t shift gears like that at the drop of a hat. It’s such a funny disconnect with me spending on others vs. myself as well. Gio needs to pay an application fee? Let me get my credit card. Family friend is visiting food banks? Time for monthly Venmo sends. Friend is craving sweets? Get a shake delivered to her front door. But here I am going “hmm would I REALLY risk it all with this purchase?” You too know it’s a journey along an unpaved road. I’m glad you can give me a piece of the map.

Darcy, hi! LT reader first time poster. Your entire post spoke to me. I grew up super wealthy and them super broke because of a bad parent. That scarcity mentality hasn’t left. My husband and I are comfortable and I have enough money to do stuff but I don’t spend. I’m embarrassed to say I have clothes that I wore in high school. I obsess over any major purchase for myself and am frugal to a ridiculous degree. I’m deathly afraid of being poor and not being able to provide for my now toddler. I work in finance but literally needed another finance dude to tell me I’ll have enough money so I can ease up. I am very lucky. I sometimes feel trapped and wish I could see another perspective. I still support the parent who caused all of this and it’s disheartening. Thanks for this post. It spoke to me more than you know.

I still have clothes from high school too, look at us two peas on a pod! If you ever want to talk about weird parental relationships I’m more than down with that. That too is a wild ride all on its own. Be well 💚

Thanks for your candid reply 🙂 The best part of this PF community is that we all have a version of weird and sometimes not great. Happy I fit in my HS school stuff but Im also on the tail end of 30’s HA so thats another thing. It’s a daily mental struggle to find balance and reading others thoughts on this really helps bridge the gap. Keep on bringing the good stuff Darcy. I appreciate you!

Really great post, and one that resonated deeply with me. I have a few decades on you, and a larger nest egg (tho you have about $220K more than I did at your age ;-), so congrats to you for crushing it), but, sadly, I still have the same anxieties as you. On the one hand, I have trouble spending with no sense of anxiety, or at least hesitation. On the other hand, however, I do know in my head that I’m unlikely to run out of money, no matter what. So, there’s hope yet that I’ll eventually have a mental breakthrough as to spending.

I was never poor growing up but my mother was uber frugal, I think it came from her mother who lived through the depression. I identify with all of these behaviors. I’m glad you are figuring this out now. I am just working through this and i’m here to tell you it does not get better with age or as your bank account rises. I have finally come to realize I will NEVER feel secure based on my bank balance. That has to come from within. Also I feel sad when I think about all the things I denied myself for YEARS (like a car) that I am now finally able to allow myself. Yes, all that self-denial is partly why my bank account is the size that it is, but I have a feeling I would have been fine if Id bought myself a car etc. a while ago. Also, the line about suppressing your wants so much that you don’t even know what they are resonated w/ me 100%. Its a behavior I am trying to unlearn now by listening to myself, but it’s hard. Much better to tackle this at your age than mine (close to 50).

People who were poor or experienced financial adversity always remember it. Think about your grandparents or great-grandparents and the Great Depression.

I’m shocked I haven’t mentioned this yet on the blog, but my grandparents on both sides were hit hard by the Depression. 3 out of 4 were born in the 20s (one in 1936) and both grandmothers had stories about growing up with poverty. The only place I can find me touching on it is in a Twitter thread from months back, I should take a gander at my family tree and make a post about inter-generational financials…

I’m am so with you on this. My entire reason for going for financial independence is my lack of trust in employers. I have a great job but I don’t trust I’ll be able to get one again if I need it. So, my goal is not to need it. It is a fight, emotionally for me to give as I just want to hoard my money.