Beat 80% of Investment Managers With This One Weird Trick

Financial advisors and investment managers HATE me! (Or perhaps… want to be me?) All because of my one weird trick that beats 80% of investment personnel at their own game! And yes, this is still the case in 2022 – my “weird trick” is giving me a better return than almost all of the top 10 mutual funds of the last decade.

This isn’t a trick to the old hats in finance, but it is for newbies and everyone else. Welcome to the world of investing, where you run the gamut of meme stocks to crypto shills to getting your financial advice from TikTok and TikTok ONLY.

All of that is child’s play compared to the big guns that are investment managers. These are the folks with very nice suits in newly-designed offices with the most prestigious clientele in the area. They are surrounded by wealth. They’ve made wealth creation their entire career. Don’t forget that well-regarded company name they operate underneath, whose expertise has made famous people millions more. All they ask for in return is some miniscule investment fee or management expense ratio (MER) in exchange for their wisdom and Midas touch. Then you, too, can enjoy the spoils of their actively managed fund picks.

Weirdly, though, the actual results don’t live up to the hype.

Only 20% of these touted managed funds, if that, actually beat the market. This means at least 80% of these frou-frou funds make you less money than a non-actively-managed fund that simply tracks the S&P 500. Since you don’t know which investment funds will be part of the 20% winners or 80% losers, you’re more statistically likely to end up paying more in fees and MERs for a crappier performance.

This means my personal weird trick – that is, investing in index funds instead of a managed/mutual fund – grants me a better investment return than 80% of those Wall Street tycoons.

Been This Way for a While

The rest of the world is apt to forget this. It’s even easier to forget this truth with all of the marketing propaganda the finance industry pumps out to cover up the truth.

As seen from a recent article I found that goes over this. “WOW,” the piece gasps, “this new research shows 80% of investment managers fail to beat the market! This is a totally shocking, never-seen-before development!!”

Which is funny, because this has been true long before this new report.

I have a list of articles every two years since 2010 saying the same thing:

2022: New report finds almost 80% of active fund managers are falling behind the major indexes

2014: 86% of active equity funds underperform

2012: “The fact is only 20% of fund managers will beat the Index over time. 80% will fail.”

And so on. This is all to say that investment fund managers are well-known for being statistically worse than if you simply stick it all into an index fund and called it good. This isn’t the same as calling a plumber when your sink is broken or a mechanic when your car is on the fritz. Having a “lazy” index portfolio is better than having someone actively manage your money.

Yes, This is Still True in 2022

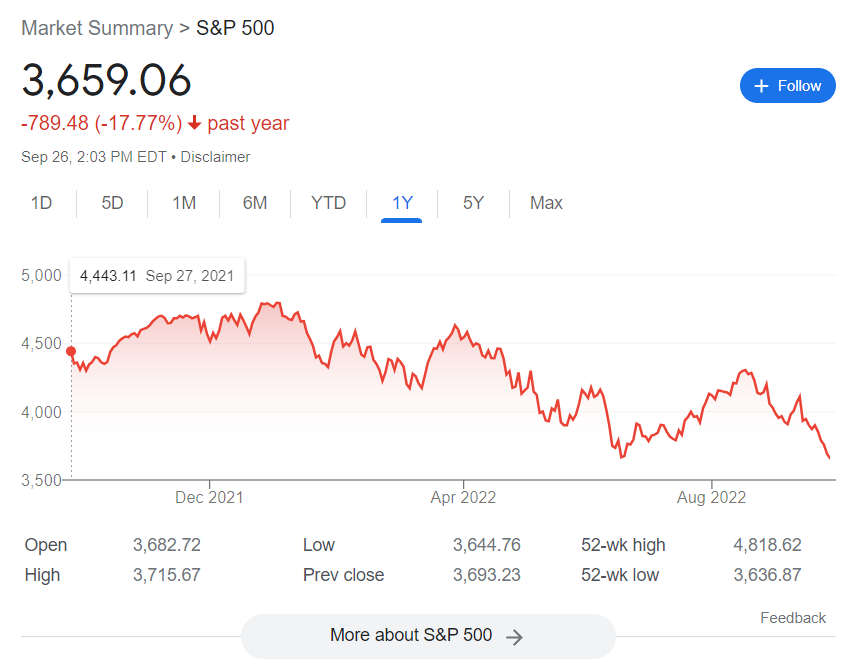

Sure, investing in a total market index fund was easy to do in the 2010s. That was the decade for the longest bull market in history, with total gains of over 400% in that time. But in 2022, a shitty superstorm of high inflation, supply chain breakdowns, and COVID effects on the workforce (among other things) have us facing a scary recession. The stock market reacted accordingly, with the S&P 500 is down roughly 18% over the last year.

We now know the return of the S&P 500 since last September: -18%. How does that compare to, say, the 10 best-performing mutual funds? Thanks to MarketWatch, I can compare and contrast how the S&P 500 performed against the mutual funds with “the best returns of the decade”. I zeroed in on how all ten funds performed over the last year, which showed me something veeeeeeeeery interesting.

Here’s a chart that makes this very interesting something much clearer:

| Name | Acronym | 1-yr. Return (Sept 2021-Sept 2022) |

| Fidelity Select Technology | FSPTX | -29.95% |

| Columbia Seligman Technology & Information C | SCICX | -21.08% |

| Baron Focused Growth Retail | BFGFX | -10.87% |

| Fidelity Select Software & IT Services Portfolio | FSCSX | -27.42% |

| Columbia Seligman Global Technology C | SHTCX | -21.71% |

| Columbia Global Technology Growth C | CTHCX | -27.82% |

| Vanguard Information Technology Index Admiral | VITAX | -20.33% |

| Fidelity Advisor Semiconductors C | FELCX | -21.40% |

| Fidelity Select Semiconductors | FSELX | -20.28% |

| Baron Partners Retail | BPTRX | -8.00% |

| S&P 500 Index | INX | -17.77 |

Out of these ten elite mutual funds, only two of them (bolded) have managed to eke out a better 1-year return than the S&P 500 (final entry, also bolded). Eight out of ten of these investment funds – aka, 80% – are confirmed to have failed to beat it.

During bull markets, investing in index funds will consistently show better returns over managed funds. During bear markets, the same holds true: you will see fewer losses than the investment managers will. It’s kind of eerie how perfectly that 80% failure rate is still accurate, despite our world facing extremely out-of-the-ordinary circumstances.

More Benefits to Index Funds

For most investors, knowing you’ll have a better return with index funds is the only reason you need to stay away from mutual funds. There are some other crucial points that also come up in index fund’s favor:

- You save a lot more in MERs and investment fees, which can mean an extra six figures in your portfolio performance

- Since index funds track the overall market, you have automatic exposure to international markets and a wide variety of industries

- If your investment strategy is 100% index funds, there is no need to rebalance your portfolio; this is the

laziesteasiest way to wealth creation

Let me be clear: index funds have proven they beat out mutual funds because of better diversification, lower costs, higher convenience, and the inability to fall to human errors in judgment. Indexes don’t care about feelings or hunches or hints of intel. All they do is match the market – which is the approach that wins you more money practically every time.

Cover image credit: Victoire Joncheray via Unsplash

Amazing job Darcy, good comparative between the funds. I only invest in VTI and have seen fewer loses this year than most.

Thanks friend! I was first comparing the mutual fund performances out of curiosity and went “waaaaaait a second,” ha. Every mutual fund charges more in commission for that human touch, which means they need to beat the market by that much just for you to break even — and even then, most cannot.