My 2022 Finances in Review

Hi all, it’s been a minute! I’ve taken some time off from writing after getting a serious medical diagnosis, which I talk more about near the end of this post. I’m back now to throw in a review of my 2022 finances while it’s still formally January. 🙂

While I might take a stab at fortune telling sometimes, there simply is no predicting how every variable will shake out. I loved seeing the wins like progress on environmental protections and a breakthrough on fusion energy that blows my sci-fi loving MIND. What I did not like seeing problems worsening around the war in Ukraine, food costs, energy costs, inflation, and everything else on the shit list. And I liked experiencing it even less. Sigh.

Maybe one day I’ll be reincarnated into the utopian society of my dreams, with Dyson spheres and free healthy food for everyone. Until then, I have a life that’s mine and the ability to contribute. So let’s review 2022!

My 2022 Spending

For reference, my spending over the previous five years:

| Year | Spend |

| 2021 | $43,442 |

| 2020 | $30,722 |

| 2019 | $29,999 |

| 2018 | $24,985 |

| 2017 | $13,280 |

My 2022 spending really proves I am not one of the lauded finance whiz kids who can effortlessly stick to budgets. Others publishing their 2022 finances report they can’t seem to increase their spending even when they don’t have a budget. I am definitely not one of them. Now that I don’t have the same fears around financial security as I once did, I’ve been paying less and less attention to my spending. Hence, why 2022 has seen me spending more than any other year of adulthood.

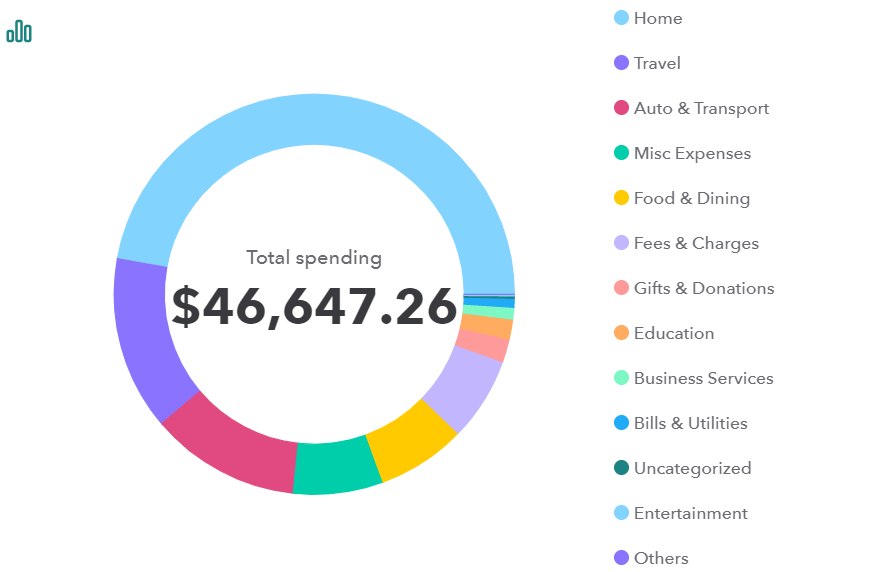

The specific amount I spent, in total, came out to:

$46,647.26

Whew! This is more than last year, when I embarrassingly assured readers it was only so high because of a car purchase and big vacation. While I did take an even bigger vacation in 2022, that’s not what drove the increased spending. No, that honor goes mainly to economic inflation and lifestyle inflation.

My biggest direct expense in 2022 was from car repairs and towing after a minor accident last January; the total cost to me was a little over $4k. Without this cost, my spending would have been right at $42k for the year.

The rest of my spending has to do with inflation. Yes, economic inflation is a big one here. I wince when I look at the price of heating my apartment and the price of almost every single food item on my receipt. Don’t even get me started on the gas price fluctuations.

I’ve also been affected by another type of inflation: the lifestyle kind. Don’t get me wrong, I haven’t suddenly bought furniture to replace all my used stuff or committed to exclusively wearing ballgowns 24/7. The lifestyle inflation is about spending more on reoccurring expenses. One example is in what I eat. My grocery bill skyrocketed after I started 1) buying more healthy/expensive foods, and 2) ending my habit of checking the prices. Nowadays, I buy what I want and don’t stick to a budget about it.

If you want to include taxes in my spending section, that’s $25,451.84. My share of employee medical insurance was $600.60 for the year.

My Spending Takeaway

I’ve spent so much energy into lowering costs in the past that I’m not exactly thrilled with this number. My feelings towards it have shown me I put more emotional stock into this than I really should, so something else to work on in the New Year. This is more than what I spent in 2021 and, again, I didn’t even buy a new car this time. I feel better about this number when I look at my Investments section. By no means is my spending a serious issue; thanks to my earnings and sound investments, it’s nothing more than something to keep a better eye on in the coming months.

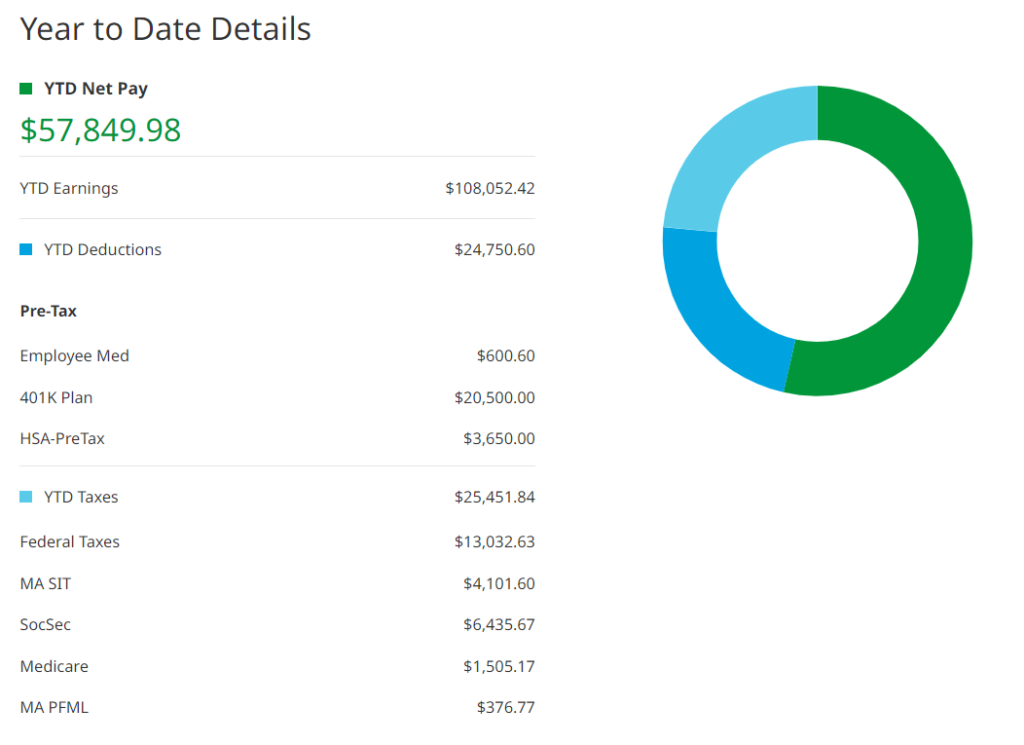

My 2022 Income

Now this freaking rocks. For the second year in a row I’ve made a six-figure salary!!

This time around I made about $5k more in pre-tax dollars than I did the year before! My net pay from my full-time job, as you can see, is $57,849.98. Besides this amount, I also made $1,056 on the side. This includes pay for writing 3 articles, getting a credit card cashback bonus, a $100 refund from a screenwriting class I took, and $101 in blog ad income. The rest ($50 or so) is via bank account interest. This number doesn’t include my investment portfolio dividends, as those belong in the next section. If you’d like to count them, that was a little over $2,500 total for the year.

In total, my net earnings in 2022 came to $58,905.67. While I did feel bad about spending as much as I did, the negativity goes away when I compare that number to this one. Yo, I still saved over $12,000 of my take-home, and that’s not counting my pre-tax investments! I’m feeling pleased as punch about that. 😊

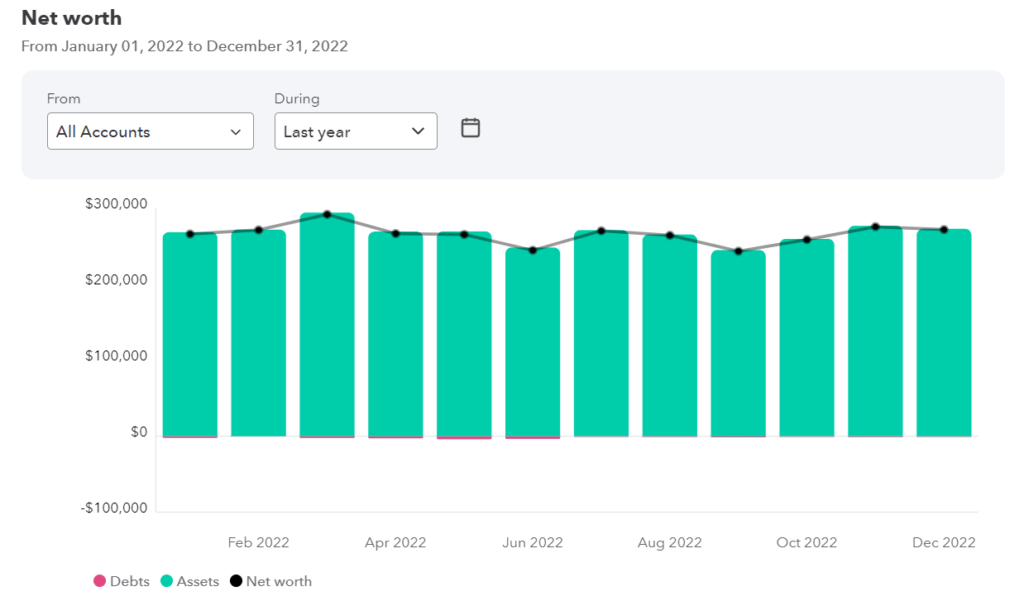

My 2022 Investments

I’m proud to say I have maxed out ALL THREE of the tax-advantaged investment accounts available to me. Between my Roth IRA, HSA, and 401(k) I’ve put $30,150 into index funds, along with another $2,600 into my taxable account. The dividends I received from said index funds further cushioned these numbers after getting reinvested.

AND YET.

MY NET WORTH WENT NEGATIVE YoY.

Egads, the horror…

…if I didn’t know to expect this.

With almost all of my money in investments, I’m guaranteed to have a down year at some point. This year was it for the S&P 500, which saw a -19.44% return. I started investing in at the start of 2017, so I now have gone six years as an investor. 2022’s returns means that my overall return has gone from 15% down to 10.96%. Which is almost exactly the rate of historical returns, and what I was told would happen.

Actually, my return is a little bit higher than what I was told would happen. So, even in a down year, I’m still coming out ahead.

Despite this I’m still sad to see that number go down. Emotionally speaking, I feel less rich than I did at the end of 2021. Logically, I know this isn’t actually the case – thanks to buying more index fund shares throughout the year, I have more assets to my name that will bring me a lot more in up years. 2023 might be that year; I rang in the New Year with a net worth in the $270k range, and as of today it’s at $282k. Guess we’ll see how things shake out in the next 11 months.

2022 Financial Summary

- Total saved/invested: $38,547.41

- Difference between net earnings and net spending $14,397.41.

- I maxed out my 401(k) and HSA, which together is another $24,150

- Including my tax-advantaged accounts as part of my total compensation, my savings rate for 2022 is 47%. Neat!

My Personal 2022: The Hells

Now for the hard stuff.

Time and time again, I make a point to say my financial awareness has placed me in a wonderful and stable position. In 2022 especially this has never been truer, and for several reasons.

Let’s get the Debbie Downer reasons out of the way first. After a year-plus of putting off seeing my doctor, I finally went in fall of last year. After doing tests, talking with the doctor about my symptoms/overall history, and providing records from other professionals, I was formally diagnosed with a serious medical condition. Given the severity of the condition, I needed a lot of time to process my new reality. This also meant reframing most of my life, as the doctor estimated I’ve had this condition since toddlerhood.

I had made a couple of social media comments naming the specific diagnosis, which I have since deleted upon learning more about it. Because I am still learning about my particular diagnosis, I’d like to keep my privacy on it as I continue navigating what this means for my life and my future. While I won’t drop dead tomorrow, I do have to face dealing with something serious and consider lifestyle changes. At some point I hope to write about the intersection, since – after all – there is a painful connection between a medical diagnosis and money in today’s America. Once I’m farther along in having this (finally) treated, I hope I can speak/write about it with calm. I’m still far from that, so please bear with me as I work to mitigate its effects.

My Personal 2022: The Highs

Let’s conclude this article on a high note. 2022 will be a treasured year for me for many reasons. The two most important reasons are because of the friendships I’ve strengthened and the big trip I got to take in the spring. Friends-wise, I’ve spent some beautiful time making a couple new friends and hugging my older ones. Travel-wise, I’ve cherished gallivanting around Europe for a month in May and June. And I get to have all of this, plus a safe apartment, enough food and water, good clothes, and a really nice job that gives me work-life balance. While life will look different with this new diagnosis, I’ve still got so much to love and to be thankful for.

This also includes the online finance community, as most of my new friends came from you guys. Thank you for making my 3 years of blogging so rewarding. 🫶

Cover image credit: Roman Kraft via Unsplash

Oh no! I’m terribly sorry to hear of your medical troubles. I wish you all the best managing it – and don’t overshare too much online!

Thank you also for your honesty in this post. There are a lot of finance blogs that I’m dubious of – people who have somehow never had to replace a roof, or remodel a bathroom, or provide medical care for a pet. Always makes me wonder if they’re being entirely honest.

The greatest advantage of being FI has been the peace of mind it brings when navigating life’s ups and downs. Sick pets, crashed cars, navigating medical treatments, all the normal (and abnormal) challenges are easier with an economic buffer. Hopefully you find the same is true for you.

Finally, lifestyle inflation is often a good thing. Some people are happy owning nothing more than fits in a suitcase; however most of us want a car, a house, a dog, a child, organic food, expensive gifts for loved ones, things that you personally value. And that’s ok. Liking your job is ok, and being professionally ambitious is ok.

Congratulations on your successes, and good luck!

Thanks so much for your compassionate comment 💚 You put it fantastically well with the “easier with an economic buffer” line. To me, the #1 critique of pursuing FI is the argument that we can’t save enough to counter all of life’s possible curveballs. Which, sure, but I’d rather deal with those curveballs with a buffer than without one!

Hello Darcy – I have been keeping track of your posts for the past 1-2 years, and it has been keeping me motivated, to say the least! Thank you very much for that – whatever struggles and success you have gone through is deeply inspirational and gives me hope. Well, let me ask you and other readers for their opinion – I am close to 50, a divorced man with no alimony obligations left whatsoever(in other words, as good as single), no debt except my car loan, have always lived in and out of rental apartments with no intent to buy a house, educated myself out of my own pocket a lot with two Masters and a Doctorate, have a pretty good job in info tech…..and coming to the point….I have managed to save a total of USD 272,000.00 in a bunch of 401ks and savings accounts. I know that is actually not much at this age but for a risk-averse conservative like me I feel it is sort of well, okay. My question is given all this information, should I feel good about it? By the time I get to 70 years of age I hope US social security will still be around though it may have been depleted somewhat.

Hi Anonymous – congrats on your educational accomplishments and financial health. According to this article, looks like you’ve been able to save more than at least half of Americans who are in your age range, which is a definite accomplishment. If you have all of that invested in index funds, and we estimate that grows by 10% a year on average, you’ll see over $700k in your accounts at 60 years old and $1.8 million at 70.

If you use the 4% rule, you can estimate the amount you can safely take out each year. At 60 with the above numbers, that’s $28k a year. At 70, that’s a lot more. If you’re retiring tomorrow it’s a different story, but you’re well on your way to a normal retirement in your 60s in my opinion.

Hi Darcy, I’m so sorry to hear about your medical problem. I have always love reading your blogs. You are so cheerful, positive, and fun. I like how you end your post with The Highs.

Does facing an unexpected health problem make you rethink FIRE or change your viewpoint of it? I hope it’s nothing detrimental and you can still pursue FIRE. But sometimes these type of events that involve our health/life of that of a love one make us rethink the idea of FIRE, the idea of live life now vs delay gratification.

Hi Hannah! I’m still planning on pursuing FIRE, but the diagnosis does have me rethinking my career plan. This weekend I was chatting with a couple of FIRE friends about the possibility of shifting from marketing to a full-on writing career; it would pay less, sure, but I’ve also got enough invested now to retire in my 40s if I want to, so… maybe this year is the time? Both friends were encouraging about the change, but that would also mean a BIG LIFE CHANGE that I’m hesitant about. Which is a long-winded reply of “I guess we’ll see,” ha. Thanks for the thoughtful comment 🙂

Health is SOOO important! I used to think all those with health problems were just weak and I’m sitting high and mighty with no health problems so that’s how I can compete against them!!

Until I find out no… I have pretty bad health problems too and in the first place, I’m not better than anyone else even if I didn’t have health problems lol

I’m glad 2022 still had high notes!! I spent WAYYY more than I was comfortable with and I had a down year too, even after making more money than I’ve ever made in my entire life.

Here’s to an even better 2023, Darcy!

I’ve managed to avoid a ton of the more common health problems so I took that as a win… until I got this diagnosis and saw I’ve actually been self-managing the worst symptoms for almost my entire life (UGH). Here’s to a better New Year, for sure!